The two patterns we are going to describe in this article are a continuation of the previous article on harmonic trading and the ABCD pattern . Remember that all subsequent harmonic patterns are based on the ABCD pattern and contain it within them.

The Garley and the Butterfly patterns discussed here are formed with 4 legs or price swings. That is the 3 legs of the ABCD pattern plus one leg in front of the ABCD.

Trading the Butterfly and Gartley patterns is very similar to trading the ABCD pattern, hence it’s strongly recommended to read that article first. All the trading rules and tactics like the entry, Stop-Loss and Take-Profit rules are the same for the Gartley and the Butterfly as for the ABCD. Therefore there is no need to repeat them here and we will just describe how to identify the patterns on the chart.

The advantage with the Gartley and the Butterfly patterns is that they offer higher probabilities for a reversal to occur than an ABCD alone would. The specific retracement level of the first XA leg in these patterns strengthens the original harmonic reversal zone of the ABCD pattern and with that strengthens the case for an actual reversal to happen later.

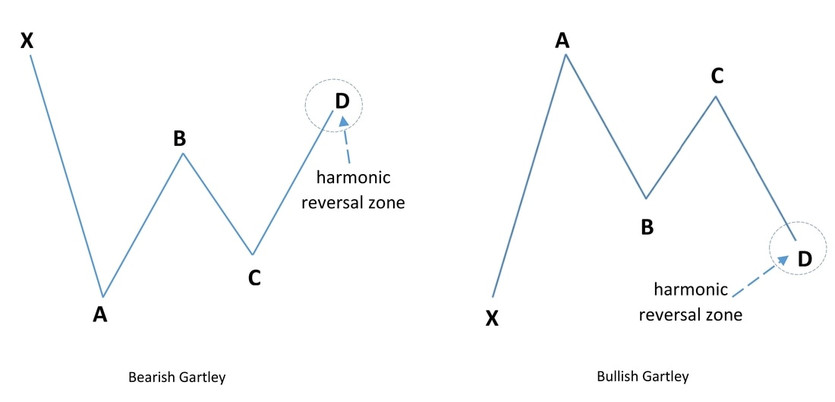

The Gartley Pattern

The Gartley is probably the oldest and best-known of the harmonic patterns. In fact, it was discovered about 100 years ago and it was used even before harmonic Fibonacci ratios were applied to financial markets, though lacking the precision we have today owing to the clearly defined Fibonacci relationships in the pattern.

The Gartley is considered a retracement pattern and it generally appears in the corrective phase of a larger trend. However, that is not necessary the case and if the Fibonacci ratios are properly aligned the pattern is still valid regardless of where it appears.

First, let’s define the most basic rules of the pattern and then we’ll discuss the Fibonacci relationships within it:

The above 5 conditions must be fulfilled for the pattern to be a Gartley in the first place. However, taking these conditions alone, even a double top or just about any simple retracement can qualify as a Gartley pattern.

The downside to this very basic approach is that such patterns don’t offer the best trade setups. Rather, it’s the specific Fibonacci alignments between each swing within the pattern that give the highest probability of a reversal and thus the best trade setups using the Gartley pattern.

Following are the Fibonacci ratios that define the Gartley pattern for the highest probability setups:

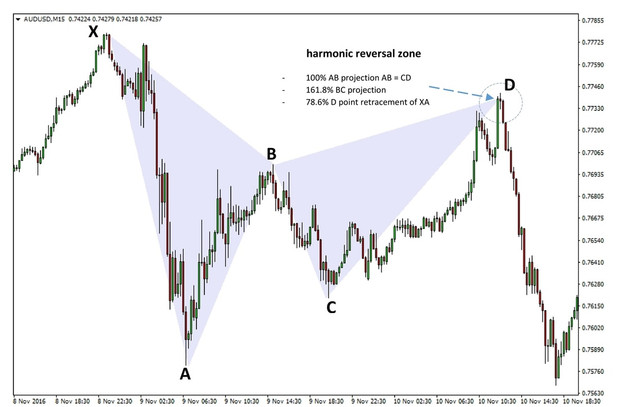

On the following AUDUSD 15 minute chart, we can see how price reversed quickly after the Gartley pattern completed in the harmonic reversal zone. Both the 38.2% and 61.8% Fibonacci targets were reached and surpassed in this trade.

An example of a bearish Gartley pattern on AUDUSD 15m chart

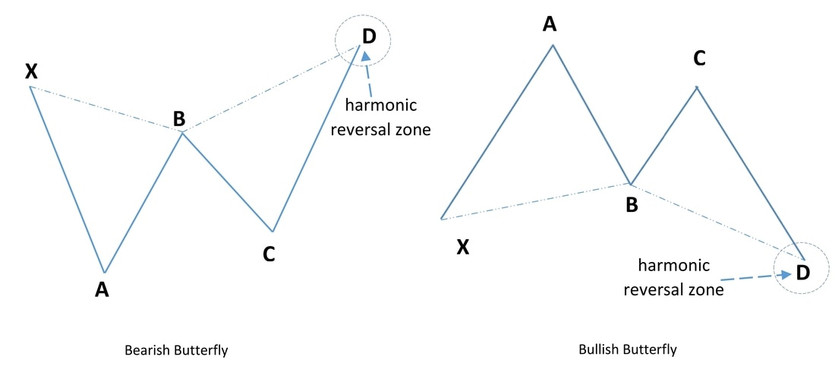

The Butterfly Pattern

The Butterfly pattern is very similar to the Gartley pattern in that it is constructed of 5 points and 4 legs, it is also visually alike to the Garley and trading them is pretty much the same.

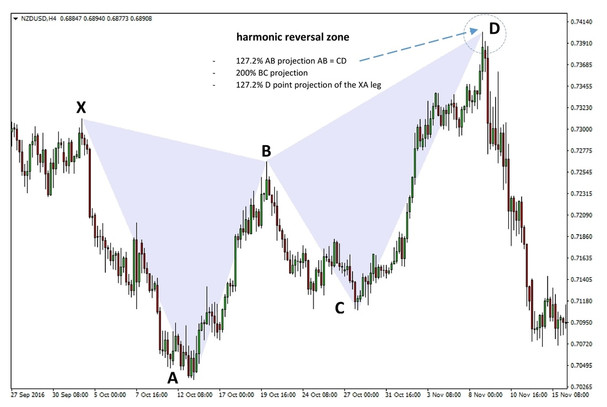

However, there are a few key differences that we will outline here, notably, the point D of the butterfly must go beyond the starting point X. Thus, the butterfly is regarded as an extension pattern instead of a retracement pattern.

It’s also important to say that a butterfly pattern on a statistical basis offers somewhat higher probabilities for a successful trade than the Gartley. Also, reversals tend to be sharper after the butterfly pattern is completed.

Again, first we’ll define the most basic rules for the pattern before discussing the best alignment Fibonacci relationships within it:

After outlining the most basic structure of the butterfly pattern, let’s see the specific Fibonacci alignments that give the best trading setups with this pattern.

In this example of a butterfly pattern on the NZDUSD 4 hour chart, price again quickly reversed from the Fibonacci harmonic reversal zone and almost reached the starting point of the pattern.

Also, note that the symmetry of the pattern is important. It should take roughly the same amount of time to form both triangles of the pattern.

An example of a butterfly pattern on NZDUSD 4h chart