Harmonic trading patterns are a strictly structured family of Fibonacci-based chart patterns that are used to forecast reversals in financial markets with a very high degree of accuracy.

Unlike most of the classical chart patterns, the harmonic patterns must possess a series of distinct Fibonacci relationships between the integral parts of the pattern in order to be valid and accurately determine highly probable reversal points in the market.

The golden Fibonacci ratio as the elemental constituent and the other accompanying Fibonacci ratios are the cornerstones of the harmonic trading method and the harmonic chart patterns.

A dozen of harmonic patterns have been developed over the years, but interestingly, all of them are founded upon one basic pattern – the ABCD pattern.

In this article, we’ll look at the ABCD pattern and discuss how to trade it. In later articles, we’ll also describe the other remaining harmonic chart patterns.

First, to understand the harmonic patterns we need to lay the foundations by sorting the specific Fibonacci ratios that are used in harmonic trading. It’s also a good idea to now input these Fibonacci levels into your Fibonacci tool.

Retracements:

Projections:

0.382

1.13

0.50

1.272

0.618

1.618

0.786

2.00

0.886

2.618

1.00

3.14

3.618

The ABCD Pattern

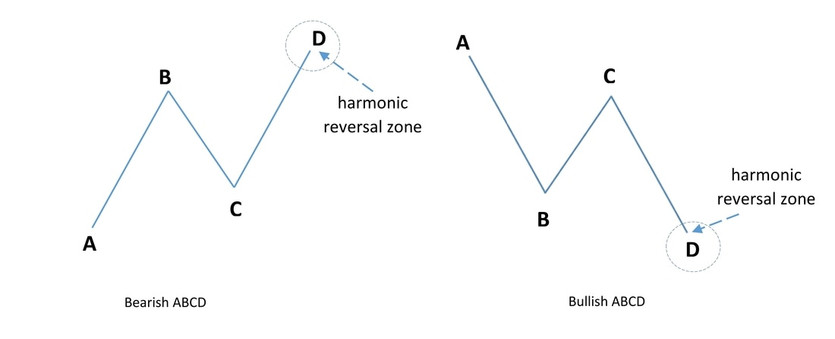

The ABCD pattern is formed by 3 market swings or legs, the AB leg, the BC leg and the CD leg as shown on the following graphic.

The CD leg will usually be of the same size as the AB leg thus this pattern is also known as the AB = CD pattern. However, the pattern is still valid if the CD leg extends and is larger than the AB leg. The ABCD pattern should also have a roughly symmetrical appearance, although that is not absolutely necessary.

The bearish ABCD pattern appears after uptrends and indicates that a bearish reversal is likely at a specific price level. Correspondingly, the bullish ABCD pattern appears at the end of downtrends signaling a bullish reversal.

The bullish ABCD patterns is a mirror image of the bearish ABCD, thus all the rules and tactics apply equally to both patterns. For the purpose of explaining the rules and tactics to trade the patterns, we will use the bearish ABCD. You can apply the same rules to the bullish counterpart in the reverse direction.

An important thing to realize about harmonic patterns is that we can derive the likely extension levels depending on the retracements in the first steps of the formation process. Here’s a general guide of the relationship between the possible point C retracements and the appropriate BC projection to each.

Point C retracement of the AB leg

BC projection

0.382

2.618

0.50

2.00

0.618

1.618

0.786

1.272

0.886

1.13

Further, the CD leg will usually be equal to the AB leg as in AB = CD. However, when the CD leg is extended it is either 1.272 x AB or 1.618 x AB. In the other more advanced harmonic patterns the CD leg can be even more extended.

Keep in mind that price will not always hit all Fibonacci levels exactly but it should do so in close proximity.

Harmonic Reversal Zone

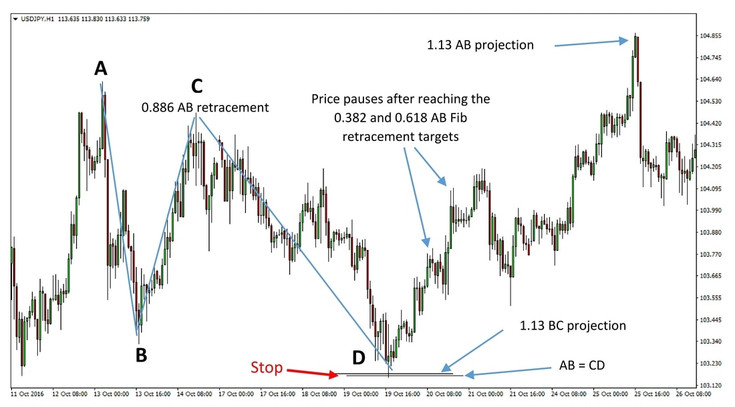

As we’ll see in the later examples the BC projection level and the AB-CD projection level should fall in close proximity to each other thus giving the harmonic reversal zone.

Entry rules:

Alternatively, a riskier approach can be used by placing a pending limit order at the harmonic reversal zone that will trigger the entry as soon as the price hits the zone.

Although this approach is technically riskier it can be used with a high degree of confidence if the harmonic reversal zone coincides with other significant signals that the price should reverse (like a nearby classic resistance or support level).

Initial Stop-Loss Placement:

- The stop-loss order should be placed a few pips behind the harmonic reversal zone (above it in a bearish ABCD and below it in a bullish ABCD).

- Price may trade the harmonic reversal zone for a prolonged period of time. It’s important to stick to the trade.

- Price may slightly overshoot the reversal zone hence it’s recommended to leave a few pips of breathing room with the stop loss (this will also depend on the timeframe – a few pips on the 1-hour chart may mean 40 – 50 pips for the weekly chart).

A bearish ABCD pattern on AUDUSD 1 hour chart

Profit targets:

- 1st target: 0.382 retracement of the AD move

- 2nd target: 0.618 retracement of the AD move

- 3rd target: Point A – Support from previous low

Support and resistance levels from higher timeframes can be combined with the ABCD targets to determine the most appropriate levels to book profits.

A bullish ABCD pattern on USDJPY 1 hour chart

Trade management:

Analyzing the price action is critical when trading with harmonic patterns.

It is important for the price to not close past the harmonic resistance zone (the 2 Fib levels in the ABCD pattern). A rejection with long shadows is a good indication that the harmonic ABCD pattern will work.

Fast price action after the reversal indicates that the first profit target at the 0.382 Fib retracement will likely be exceeded and in this case, it’s reasonable to target the 0.618 Fib retracement as the first target for a greater profit.

Conversely, slow price action in the direction of the reversal indicates that the first target at the 0.382 level might be the only target that will be reached and as such we should be more risk averse and book profits quickly.