This article was first sent to subscribers of the Free Profitable Forex Newsletter on May 6 2022.

Hey! This is Philip with this week’s edition of the Free Profitable Forex Newsletter!

It is the end of a very busy week that featured the Fed and BOE meetings and wrapped up today with the Nonfarm Payrolls and Canada’s jobs releases. With the dust now having settled a little, it seems evident that this market wants to consolidate.

For instance, despite the eventful calendar, most major Fx pairs remain inside their ranges from last week. Indeed, the market has already moved quite dramatically in April, with GBPUSD down 800 pips, EURUSD down almost 600 pips, and USDJPY up 900 pips. The scale of these moves suggests a healthy consolidation is needed.

The Fed hiked rates by a “large” 50bp on Wednesday and pretty much delivered all the hawkishness the market expected, while today’s Nonfarm Payrolls was solid and mostly in line with consensus estimates. Yet, that wasn’t enough to push the USD higher in a market that is very long dollars and already expected a very hawkish Fed and robust NFP report. Instead, both the Fed and NFP events seem to have resulted in a sort of “buy the rumor sell the fact” reaction.

Still, the Fed was far from dovish, and the solid NFP is fully supporting more hawkishness and rate hikes from the Fed this year. At the same time, there is no continuation of the bullish dollar trend either. Hence, we can draw a conclusion that the most likely scenario for the coming 1-2 weeks is consolidation.

That being said, there is little doubt that the USD bull trend is intact, and there are few who would want to stand in its way. Market trends don’t move in a straight line, and this one is no different. But eventually, the US dollar should remain strong over the coming months, driven by the more hawkish Fed relative to other central banks and the stronger US economy relative to others.

Following this up with some charts, below we look at the very-short term picture of EURUSD GBPUSD USDJPY:

EURUSD 4H chart

Here, we can see a clear bear flag formation emerging following the steady bearish trend from April. Notice how the post-Fed and today’s NFP reactions remain fully contained in the flag formation.

If we extrapolate the flag to the right, we can see that it could last well into the middle of this month. So, this consolidation in EURUSD could take 2-3 weeks or more before an eventual (and likely) continuation to the downside.

USDJPY chart

The consolidation in USDJPY may be in the most mature phase and may have already ended with the Fed meeting. Here, the bull trend is strong, and the Bank of Japan doesn’t mind the weakness of the yen. The technicals are clearly bullish, and we expect the pair to keep moving higher toward the 135.00 area over the coming weeks.

GBPUSD 1H chart

Sterling is beaten down hard, so consolidation is perhaps less likely here, but with still decent probabilities. The key technical zones to watch are 1.23 and 1.24. GBPUSD needs to hold above 1.23 into the weekly close to retain some chances for a rebound next week. A break above 1.24 would only make such a correction even more likely.

On the other hand, continuation to the downside would likely result in a move toward the 1.20 area. However, expect this scenario to unfold in a very gradual manner, unlike the fast decline we saw on the Bank of England announcement yesterday.

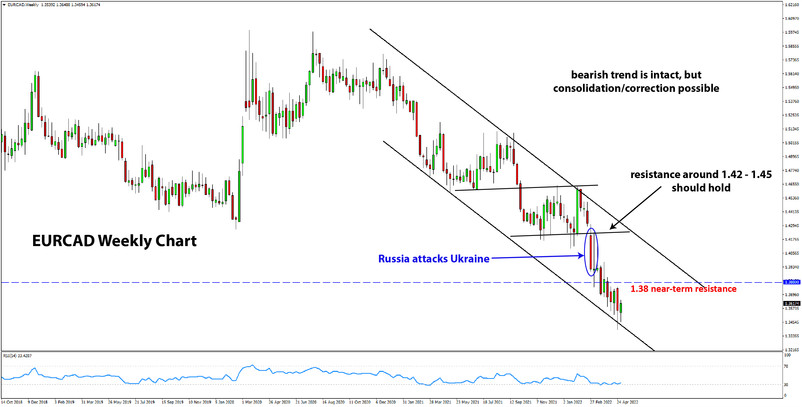

EURAUD & EURCAD downtrends also likely to continue, but beware of RISK-OFF corrections

Finally, let’s have a word on EURAUD and EURCAD. These pairs are also in downtrends, and the longer-term fundamentals favour an extension to the downside. This is all based on the current backdrop of high commodity prices in general, which should support the commodity-exporting economies (Australia, Canada) versus commodity importers (Europe, Japan).

However, short EURAUD and EURCAD come with the caveat that they are at greater risk of an upside correction in case of a wave of risk aversion (e.g., if stocks sell-off hard). We already saw this yesterday, when both AUD and CAD sold off together with stocks. If the stock sell-off continues next week, then EURAUD and EURCAD will likely correct further to the upside.

Nonetheless, as long as equity volatility remains contained, then EURAUD and EURCAD should progress lower over time. In this regard, it makes sense to look for potential rallies to fade and enter short.

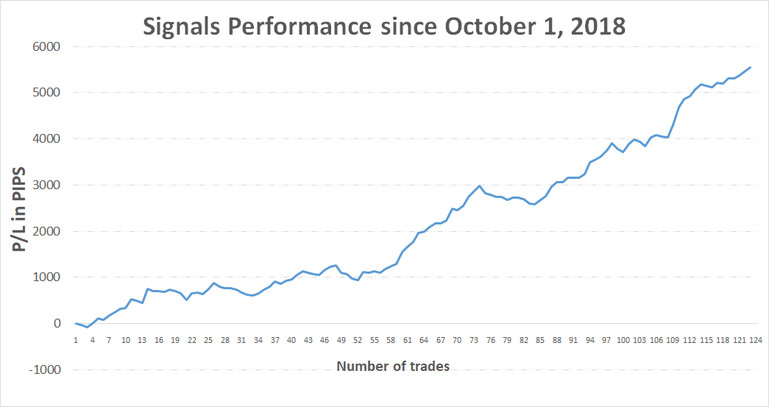

Trade signals from the past weeks

- May 02, 2022 - Long USDJPY from 130.10, holding this trade as the recovery from below 129.00 was rather quick, even though it dipped below on the volatility during the Fed press conference (trade idea sent April 28)

TOTAL P/L in the past week: N/A

TOTAL: +5540 pips profit since October 1, 2018