Corrected AMA is a specially developed version of the standard moving average that can be used in trend trading. The indicator is used to determine the current trend, and thus allows finding the best moment to open positions in its direction. The indicator allows performing these actions due to convenient visualization. It is presented directly in the main window of the price chart in the form of two moving lines, which, depending on the current market conditions, move in a certain direction and are painted in one of two colors, which in turn characterize a downtrend or an uptrend. Their definition using the indicator will allow opening a specific trade.

The Corrected AMA indicator can be used on any timeframes, with any currency pairs, as it is equally effective when choosing any values.

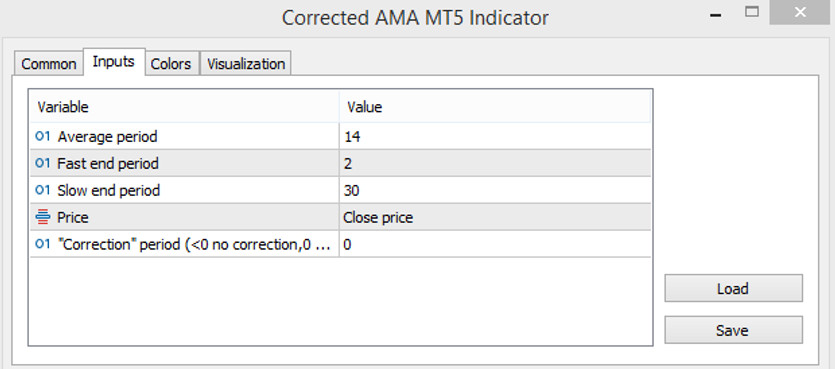

Input parameters

The Corrected AMA indicator in its settings has input parameters that are directly related to the execution of the technical work indicator. Its settings also have an additional section that affects the color gamut and thickness of the indicator values.

- Average period - calculation period used by the indicator. The default value is 14.

- Fast end period - value of the end period of the fast moving line. The default value is 2.

- Slow end period - the period of the end of the slow indicator line. The default value is 30.

- Price - price to which the general calculations of the indicator will be applied. The default value is Close price.

- Correction period (<0 no correction,0 to 1 same as average) - parameter responsible for the correction of the indicator calculations. By default, it has a value of 0, while if the parameter value is below 0, then the correction is not applied if the value is selected in the amount from 0 to 1, then a correction equal to the moving average is used.

Indicator signals

The Corrected AMA indicator is used to trade with the trend, and accordingly, before opening a certain position, the current trend is determined. That is, the direction of the current trend and the trade directly will depend on the general direction of the indicator lines, their color, as well as their intersection with each other. Once in the market an uptrend is determined - buy trades are opened, and if the trend is down, then sell.

Signal for Buy trades:

- The main line of the indicator intersects with the second one so that it turns out to be higher than it. At the same time, both lines of the indicator move up and have a color with a growth value.

After receiving the full combination of conditions, a long position can be opened on the signal candle, due to the presence of an uptrend. Stop loss should be placed below the signal candle. It is recommended to close the position after receiving the opposite conditions, namely, changing the color of the lines or their reverse intersection. This may indicate a possible change in the current trend, which will allow considering opening new trades.

Signal for Sell trades:

- The indicator lines move down and have a color with a falling value, while the second indicator line is higher than the main one.

A sell trade can be opened on a signal candle immediately after receiving such conditions. A stop loss order should be placed above the signal candle. Such a trade should be closed immediately after receiving the opposite conditions, namely after changing the color of the lines or their reverse intersection. This will indicate a possible formation a new trend, which will allow opening new trades.

Conclusion

The Corrected AMA indicator is not only an effective, but also a convenient trading algorithm that allows making trades by determining the current market trend. In addition to independent use, the indicator is also suitable for various strategies that will increase the accuracy of its signals. For proper use and ability to apply the algorithm in practice, it is recommended its preliminary use on a demo account.

You may also be interested The NonLag Dot trend trading indicator for MT5