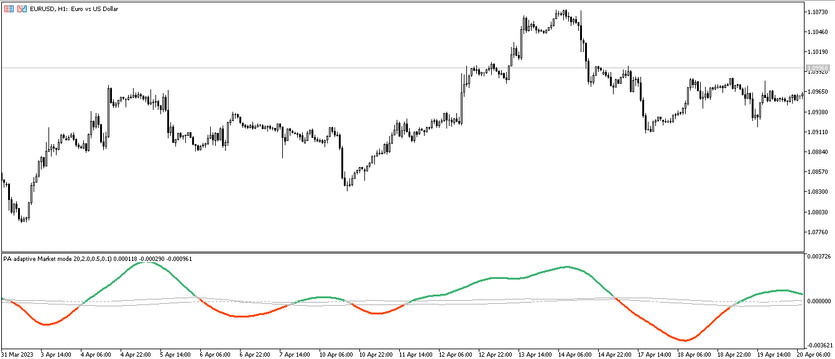

The PA Adaptive Market Mode indicator is a trading algorithm designed for trend trading, namely to determine the direction and strength of the current trend. The PA Adaptive Market Mode indicator is displayed in the lower window of the price chart as a solid line, which, under certain market conditions, is color and changes its direction relative to the signal level. That is, to open a certain trade, current values should be taken into account, which in turn determine information about the current market trend.

The PA Adaptive Market Mode indicator can be used to trade on any time frame with any currency pair.

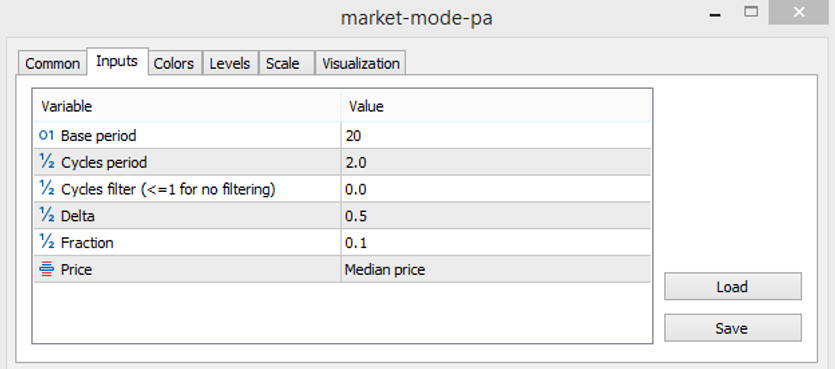

Input parameters

The PA Adaptive Market Mode settings, consisting of input parameters, are used to change its technical work and general functioning, therefore, when changing the parameter values, the selected timeframe and currency pair should be taken into account.

- Base period - value of the main period of the indicator. The default value is 20.

- Cycles period - cycle period of indicator values. The default value is 2.0.

- Cycles filter (<=1 for no filtering) - period for filtering indicator cycles. By default, it has a value of 0.0, while the filter will not be used if the parameter value is <=1.

- Delta - period of smoothing the indicator values. By default it has 0.5.

- Fracton - segment of indicator calculations. Default value is 0.1

- Price - type of the price to which the indicator calculations are applied. By default, it has the Median price value.

Indicator signals

The PA Adaptive Market Mode indicator is very easy to use. To open a certain trade, it should be used to determine the current trend, namely its direction and strength. To do this, take into account the direction, color and location of its line relative to the signal level. If the current trend is strong upward, long positions can be opened, if the trend is strong downward - short positions. When the current trend changes, in both cases trades are closed.

Signal for Buy trades:

- The indicator line has a color with a growth value and goes from bottom to top, crossing level 0.

Upon receipt of such conditions, a buy trade can be opened on the signal candle, due to the presence of an uptrend in the current market. It should be closed when the trend changes, namely when a reverse signal is received from the indicator. At this moment, it should be considered opening new trades.

Signal for Sell trades:

- The indicator is located below the signal level and its line has a color with a falling value and moves down.

A sell trade can be opened immediately upon receipt of such conditions on a signal candle. At this moment, an uptrend is determined in the market. The trade should be closed when the trend changes, namely, when the opposite conditions are received. At this moment, the indicator gives a signal about the possible opening of new trades.

Conclusion

The PA Adaptive Market Mode indicator is very easy to use, while it is also very accurate in signals, which in turn allows for efficient trading. Before using the indicator on a real deposit, it is recommended to use a demo account in order to use indicator correctly and improve trading skills.

You may also be interested The ADX VMA Histogram Trading Indicator for MT5