The Standard Relative Strength Index (RSI) is quite common in trading strategies and has a positive reputation even among large exchange traders, but it has one drawback - it is too prone to market noise. For this reason, RSIOMA was created, devoid of this disadvantage.

The main formula in the RSIOMA indicator remained unchanged - it still compares the ratio of the average positive and negative market fluctuations for the selected period, but if the classic RSI builds its calculations based on actual prices, then its updated version is based on a moving average.

Simply put, first, the moving average values are determined on the chart, after which the RSI formula is applied to them. It is worth noting that you can get a similar result using the standard MetaTrader4 toolkit since the built-in relative strength index has such an option.

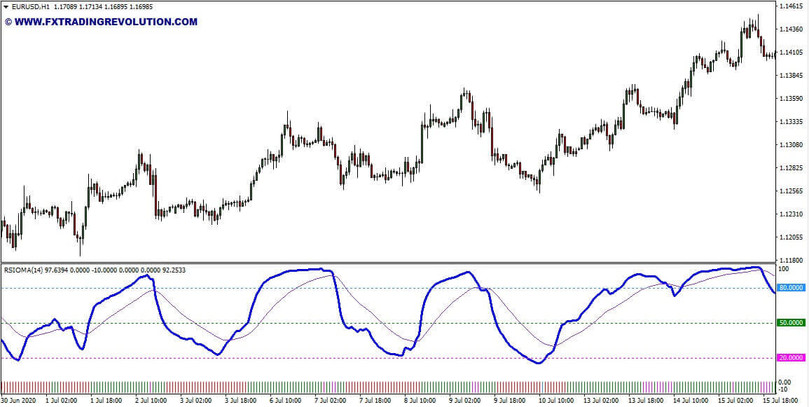

The bold blue line is the RSIOMA indicator itself. In fact, as the formula suggests, it shows the relative strength index of the moving average. Even with the naked eye, you can see that the dynamics of the updated version is smoother than that of the classic RSI.

In addition, RSIOMA, made for MetaTrader4, contains an additional auxiliary module, presented in the form of a multi-colored histogram.

RSIOMA Indicator for MetaTrader 4

Indicator settings

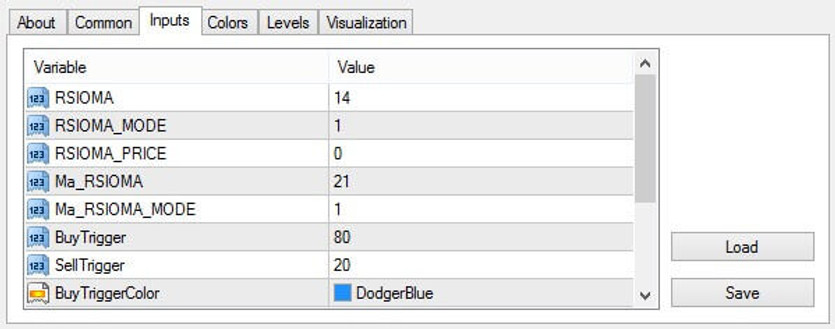

RSIOMA has the following settings:

- RSIOMA - the period of the RSI itself and the moving average, on the basis of which it is built. For example, if you specify ten here, you will first get MA (10), after which the indicator will apply the RSI formula (10) to it;

- RSIOMA_MODE - moving average type (0 - simple, 1 - exponential, etc.);

- RSIOMA_PRICE - the type of price at which MA is built (close, open, typical, etc.);

- Ma_RSIOMA - additional signal moving average period. It is represented by a thin line on the chart;

- Ma_RSIOMA_MODE is the type of this signal MA.

RSIOMA for MT4 Settings

RSIOMA signals

A sequence of green/red bars indicates a predominance of bullish/bearish sentiment, while areas colored pink and blue indicate oversold and overbought, respectively.

- In particular, overbought is understood as a situation in which the oscillator line is above the upper extremum level. By default, it is 80%.

- Oversold is defined in a similar way, only, in this case, the RSIOMA algorithm must break through its lower extreme bar. Usually, it is set at 20%.

In the Forex market, to generate trend signals, you can also use not a strictly 50 percent bar, but a special corridor is corresponding to a flat.

Conclusion

Thus, the considered RSIOMA indicator is much more effective than the usual strength index. The only area where it yields to the standard RSI is divergence analysis. In this regard, the updated modification will be useless. It is recommended to use this indicator in conjunction with other additional technical tools.

Tip: Can’t open the downloaded archive file (ZIP or RAR)?

Try WinRAR for Windows or The Unarchiver for Mac .

Do you need help with installing this indicator into MT4 for Windows or Mac OS? Our guide HERE will help you.