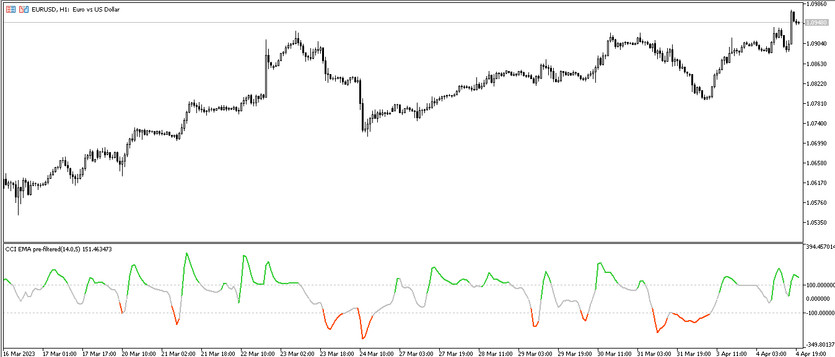

The CCI Averages Prefiltered indicator is a trading algorithm based on the calculations of the standard CCI indicator using 18 moving averages of different periods as filters for the main signals. Its calculations are aimed at determining the presence of a trend in the market, its direction and strength, which in turn are the main factors to enter the current market. The indicator is represented in the lower window of the price chart as a solid line, which, under current conditions, moves in a certain direction relative to the signal levels and has a certain color. These indicator factors determine the current trend direction.

The CCI Averages Prefiltered indicator is suitable for use with any currency pairs on any timeframe.

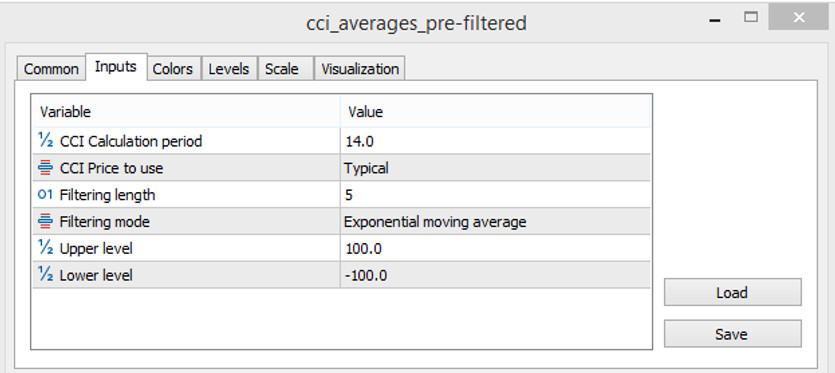

Input parameters

The CCI Averages Prefiltered indicator settings consist of several sections. Thus, the Input Parameters section uses values that affect its general technical operation, the Colors section is responsible for its color scheme and the general visualization of lines, while the Levels section is responsible for adding additional signal levels.

- CCI Calculation period - value of the CCI indicator calculation period. The default value is 14.0.

- CCI Price to use - the type of price to which the CCI indicator calculations are applied. The default value is Typical.

- Filtering length - length value of the calculations used for filtering. The default value is 5.

- Filtering mode - type of moving averages used to filter indicator calculations. By default, it is set to Exponential moving average.

- Upper level - value of the upper signal level of the indicator. The default value is 100.0.

- Lower level - value of the lower signal level of the indicator. The default value is -100.0.

Indicator signals

The CCI Averages Prefiltered indicator is a trend indicator, so trading with it is made only if there is a certain trend in the current market. When moving sideways, that is, when the line is between the signal levels, trades are not opened at all. To determine the direction of the current trend, one should take into account the color, the direction and location of the line relative to levels 100 and -100. If the indicator determines an uptrend, long positions are opened, if the trend is down, short positions are opened. When the current trend changes, trades are closed.

Signal for Buy trades:

- The indicator line moves up and is located above the level of 100, having a color with a growth value.

Upon receipt of such a condition, a long position can be opened on the signal candle, due to the presence of an uptrend in the current market. It should be closed when the current trend changes, namely, when the color and direction of the line change. At this moment, the weakening of the current trend is determined, which will indicate its possible change. At this moment, it should be considered opening new trades.

Signal for Sell trades:

- The indicator line has a color with a falling value and moving down is located below the signal level -100.

A sell trade can be opened immediately upon receipt of such conditions that determine the presence of an outgoing trend in the market. Upon receipt of reverse conditions from the indicator, the trade should be closed. At this moment, the weakening of the current trend is determined, which will later turn out to be its change. This, in turn, will allow considering the opening of new trades.

Conclusion

The CCI Averages Prefiltered indicator is based on the calculations of an effective forex indicator, the signals of which are more accurate due to the presence of a filter in the form of a moving average. The indicator is very easy to use, thus it can be used by traders with different levels of training. To the correct application of the algorithm and obtaining the necessary trading skills, it is recommended preliminary practice on a demo account.

You may also be interested The Zerolag TEMA Bars Signal trading indicator for MT5