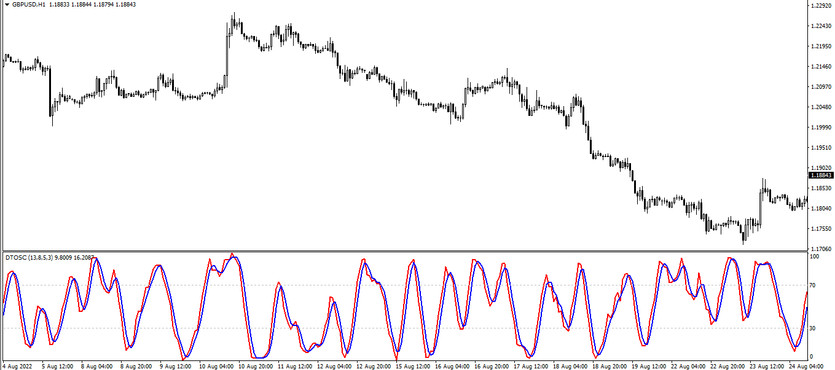

The DT Oscillator is used in trading as the main tool that allows determining the current market trend and thereby finding the best moment to open a certain position at this moment, while the indicator is also suitable for determining whether the market is in the overbought or oversold zone. DT Oscillator is a whole combination of indicators, so it can be considered a full-fledged effective strategy. It is represented in the lower window of the price chart in the form of two lines that, under certain market conditions, intersect with each other, while changing their position relative to their signal levels 0, 30, 70 and 100. Thus, taking into account the location of the indicator lines relative to their signal levels, each other will be considered the main signal that helps determine the current trend and open a trade in its direction.

The DT Oscillator indicator is suitable for use on any timeframes, with any currency pairs, as this does not particularly affect its technical work.

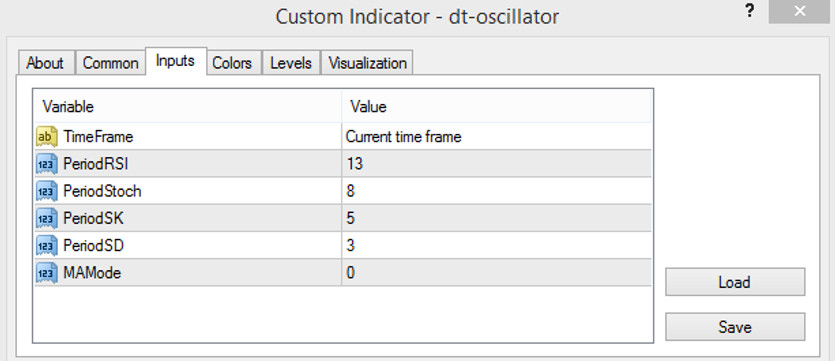

Input parameters

The DT Oscillator indicator settings consist of six input parameters, which should be changed taking into account other trading conditions and values. The Colors sections of the indicator are responsible for its color scheme, and the Levels for adding additional signal levels to its window.

- TimeFrame - parameter responsible for choosing a trading timeframe. By default, it has the Current time frame value.

- PeriodRSI - the period for using the RSI indicator. The default value is 13

- PeriodStoch - value of the period for using the Stochastic indicator. The default value is 8.

- PeriodSK - period of the slow signal line of the Stochastic indicator. The default value is 5.

- PeriodSD - period of the fast Stochastic signal line. The default value is 3.

- MAMode - type of smoothing used moving average. The default value is 0.

Indicator signals

The DT Oscillator indicator is used in trading to determine the current trend and open trades during this period. This is done by taking into account the location of the indicator lines relative to its signal levels and each other. Thus, if all the conditions confirming an uptrend match on a certain candle, long positions are opened, and if conditions characteristic of a downtrend are formed, then the positions are short.

Signal for Buy trades:

- The indicator lines start moving up and rise above the level of 70. At the same time, its lines intersect so that the color line with the growth value is higher than the one with the fall value.

After receiving such a combination of conditions, a long position may be opened on the signal candle due to the presence of an upward trend. Such a position should be closed after the indicator lines cross in the opposite direction. This will signal a change in the current trend, which will allow opening new trades.

Signal for Sell trades:

- The indicator lines intersect so that the line with the falling value is higher than the line with the rising value. In this case, both lines fall below the level of 30.

A sell trade can be opened immediately after receiving such conditions on a signal candle. The trade is closed after receiving a reverse intersection of the lines, which will indicate a change in the current downtrend. This will allow considering opening new positions in the direction with a new trend.

Conclusion

The DT Oscillator indicator is a very smart and efficient trading system based on the functioning of several indicators, the accuracy of which has been proven by time. In addition, it is extremely easy to use and will suit traders with any level of experience. However, this does not negate the fact that before trading it is better to use indicator on a demo account.

You may also be interested The SSA of WPR MACD trading indicator for MT4