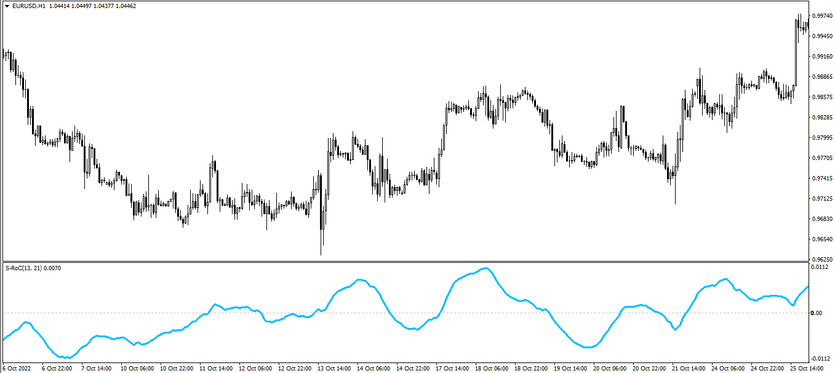

The Smoothed Rate of Change indicator, which may also be known as S-RoC, was developed based on the functioning of the calculations of several forex indicators, and is a very effective trading algorithm. It is used to determine the optimal moment to enter the market, and accordingly, to determining the current trend. The indicator is presented in the lower window of the price chart as a line, which, under certain market conditions, changes its direction and location relative to the signal level 0. Positions using the indicator must be opened taking into account the location of the indicator line and the current trend.

The Smoothed Rate of Change indicator is suitable for use on any timeframe, with any currency pairs, since the choice of these values will not affect the effectiveness of the indicator in any way.

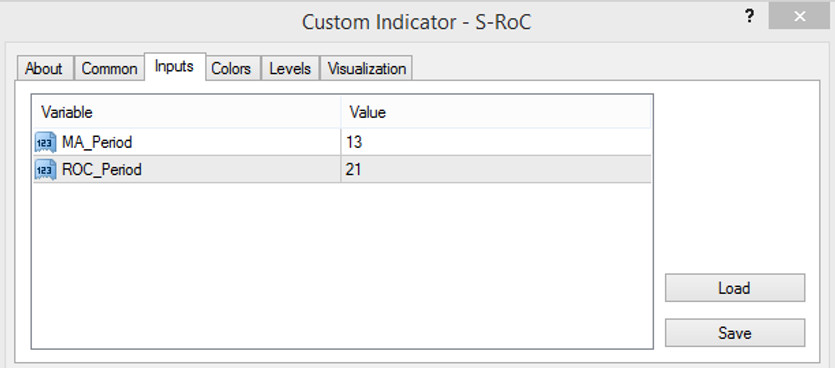

Input parameters

The S-RoC indicator settings only consist of two input parameters, so they cannot be considered advanced, however, their presence and the ability to change them allows bringing accuracy to trading. Its settings also have a Colors section, which is responsible for its general color scheme and Levels, with which can be used to add signal levels to the indicator window.

- MA Period - period of the exponential moving average, which is used in the calculation of the indicator. The default value is 14.

- ROC Period - the period of the Rate of Change indicator. The default value is 21.

Indicator signals

The Rate of Change indicator works perfectly during a certain market movement, and therefore, at any moment, as soon as a new trend is formed on the market, any trade can be opened in line with the trend. If the trend is up, then the position is long, and if the trend is down, then a short position .At the same time, it is important to take into account that the indicator still works during the period of divergence in the market, and even at this moment it functions as accurately and correctly as possible.

Signal for Buy trades:

- The indicator line, which has fallen below level 0, will begin to go up.

After receiving such a condition, on the candle, on which the line changed direction and began to move up, a long position can be opened, due to the presence of an uptrend in the market. Such a position should be closed after the line breaks through its level 0 and reaches its peak. At this moment, it should be prepared for a possible change in the direction of trades.

Signal for Sell trades:

- The indicator line, moving up, rises above level 0, and after reaching the top, it starts moving down.

A sell trade can be opened on a signal candle immediately after receiving such conditions. It is recommended to close such a trade if the indicator line drops below level 0 and reaches its lowest point. At this moment, it can be considered opening new positions due to a change in the current downward trend.

Conclusion

The Rate of Change indicator is a mini strategy, thanks to which any trade made promises to be effective and profitable. Its ease of use can help novice traders develop their trading skills and gain good trading experience. However, before the working with the algorithm is started, preliminary practice on a demo account is recommended.

You may also be interested The HMA Trend Arrows TT Trading indicator for MT4