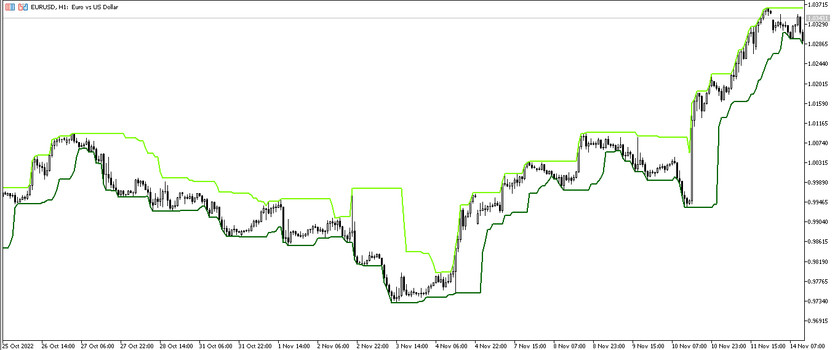

The Turtle Channel is an indicator that is used in trading to find the optimal moment to enter the market by using a special channel. The indicator is displayed directly on the price chart as a channel consisting of two lines: upper and lower. Thanks to these lines, namely, taking into account the location of the current candle relative to these lines, a certain position can be opened. According to the scheme of operation, this algorithm resembles the use of indicators such as Bollinger Bands or Donchian Channel, however, its calculations are in no way connected with these indicators, however, the fact itself simplifies the use of the indicator.

The Turtle Channel indicator is suitable for any currency pairs and timeframes, however, to increase the efficiency of the algorithm, it is recommended to choose not very large or small time intervals and pairs with high volatility.

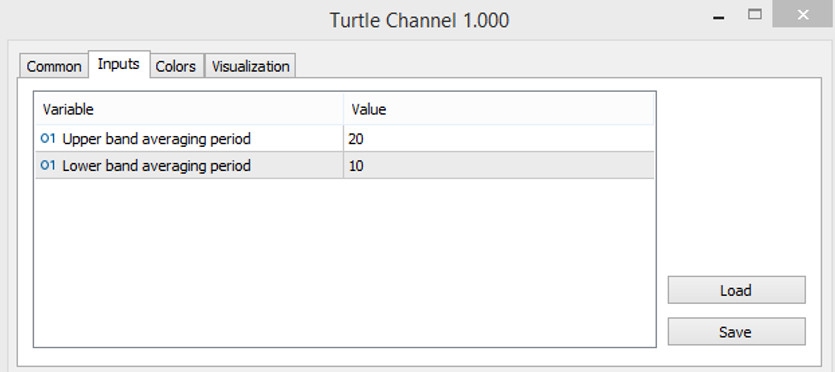

Input parameters

The Turtle Channel indicator has only two input parameters in its settings, but their number does not affect its technical work in any way. The indicator settings also have a Colors section that allows selecting the optimal color scheme and thickness of the indicator values.

- Upper band averaging period - period of averaging calculations related to the upper line of the indicator. The default value is 20.

- Lower band averaging period - the period of calculation of the lower line of the indicator. The default value is 10.

Indicator signals

As mentioned earlier, the Turtle Channel indicator is very similar in use to the Bollinger Bands and Donchian Channel forex indicators. That is, it works on the principle that as soon as the signal candle touches the upper or lower line, a certain position can be opened. If the candle touches the upper border, a long position is opened, and if it is lower, a short position is opened.

Signal for Buy trades:

- The channel consisting of the indicator lines is moving upwards. The signal candle should reach the upper border of this channel.

After receiving such conditions from the indicator, a buy trade can be opened on the signal candle. It should be closed after the indicator channel goes down again and a certain candle touches its lower border. At this moment, it should prepared to open new trades in the other direction.

Signal for Sell trades:

- The indicator lines that form the channel are moving down. The signal candle should touch the lower border of this channel.

A sell trade can be opened immediately after receiving such conditions. It is needed to close it after a certain candle touches the opposite border of the indicator channel. At this moment, it should be considered opening new positions in the other direction.

Conclusion

The Turtle Channel indicator is a very simple, but at the same time effective algorithm that allows trading quickly and profitably. This algorithm can be used both separately and with additional indicators that will increase its efficiency and accuracy. However, before any of its use, preliminary practice on demo account.

You may also be interested The MACD Top Bottom Trading Indicator for MT5