Dealing with the bearish trend in the Forex market is a very challenging task. Those who have switched to the currency trading business after trading the stock market often get confused while shorting the trading asset.

They prefer to make money by shorting the pairs. In order, you need to speculate the direction of the trend with a high level of accuracy. Just by speculating the direction you can make money in a falling or rising market.

Trading the bearish trend line is not all hard. But you must know the key method to trade the bearish trend line. For instance, those who don’t know the perfect way to draw the bearish trend line are not going to earn money. They might end up blowing up the trading account. So, let’s learn about the key steps that can help you trade the bearish trundling with a high level of accuracy.

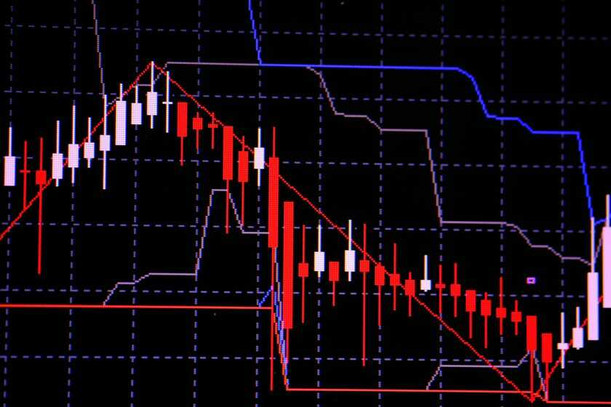

Drawing the bearish trend line

To draw the bearish trend line, you need to learn about the key swings of the market. Connect three higher lows in the market to find your desired bearish trend line.

Those who connect the three higher lows in the market in the lower time frame gets the minor trend line. But trading the minor trend line is not the perfect way to start your trading career.

You need to draw the trend line in the daily or weekly time frame. By doing so you will always get the major trend line.

Shorting the pairs

To short the pairs, you need to wait for the bullish pullback. However, you should never try to trade with real money as a new trend trader.

Use the Forex trading demo account and start trading with the virtual dollar. Instead of using the low-end demo trading account, you should open the demo account with professional broker Rakuten.

Use their advanced tools to find the potential bearish trend line in the trading asset. Once you have drawn the trend line, you need to wait for the retest of the trend line.

The naïve trader softens short the pairs in the first retest but some of the traders use the bearish price action confirmation signals. The bearish price action confirmation signals allow the traders to trade the market with tight stops.

By using the tight stop, you get the unique opportunity to reduce the risk exposure. And this eventually allows you to trade with big volume which increases the profit factors to a great extent.

Setting up the risk to reward ratio

After you have executed short orders in the market, you have to analyze the risk to reward ratio. Since you will be trading the longer time frame, you can easily get a 1:5 risk to reward ratio . But sticking to the trade for such a long period might be a little bit challenging for the naïve traders.

For this reason, the elite traders always suggest booking the profit once they manage to earn a decent profit. You can also start using the trailing stop loss features since it will significantly boost the profit factors at trading. But make sure you not using too tight stops as it will close the trades too early.

Analyze the major news

You must learn to analyze the major news to trade the bearish trend line. Before you start to decide to trade, make sure you analyze the high impact news.

Think about the elite traders and try to place the trade just like them. They never execute any short trade based on the trend line resistance. They always focus on the high impact news and see if the price is going to respect the bearish trendline resistance.

Once you learn to trade this market like them, you can slowly increase the risk to 2-3%. But still, you need to be prepared for the losing trades. Losing trades are nothing but a part of this profession.