Understanding Pullback Trading

Pullback trading, at its core, is a financial strategy that hinges on purchasing an asset post a brief price drop, with the anticipation that its value will bounce back to the original ascending trend. This approach can lead to substantial profits; however, it's vital to be aware of the associated risks. For instance, there's always a chance that the asset won't follow the predicted trajectory, which could result in potential financial losses.

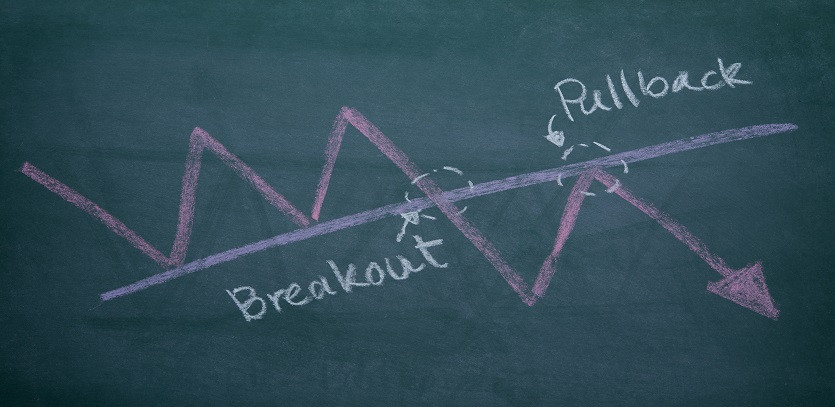

The Mechanics of Pullback Trading

The foundation of pullback trading lies in the belief that markets typically move in a certain direction or 'trend.' In an upward or bullish market trend, the prices tend to surge over a period, followed by a brief dip – referred to as a pullback. The underlying assumption is that the price will eventually revert to its initial upward climb following the conclusion of the pullback. Therefore, traders purchase the asset after the dip, banking on the prediction of a subsequent price increase.

Contrasting Pullback Trading with Other Strategies

Pullback trading sets itself apart from other trading strategies through several distinctive features. To start with, it is a strategy that follows trends, meaning traders focus on assets that already display an upward trend. Secondly, the approach seeks short-term price dips rather than substantial markdowns. Lastly, traders practicing pullback trading often incorporate stop-loss orders as a safety net to guard their earnings.

Pros of Pullback Trading

The appeal of pullback trading lies in several advantages. Most notably, it has the potential to yield high profits. It can also be a safer strategy compared to others, like day trading, for instance. Additionally, pullback trading doesn't require continuous market tracking, making it a more passive trading method.

Potential Risks of Pullback Trading

Despite its merits, pullback trading is not devoid of risks. The most prominent risk is the absence of a guarantee that prices will revert to the bullish trend after the pullback. Another risk involves potential losses if the price plummets beyond your stop-loss order limit. Also, this strategy can be time-intensive as it requires vigilance for possible pullbacks.

Pullback Trading: Practical Advice

Identify upward trending assets using technical analysis.

Watch out for brief price dips not connected with major sell-offs.

Implement stop-loss orders to safeguard your earnings.

Final Thoughts

For seasoned traders, pullback trading can provide an opportunity for profit with relatively less risk. However, recognizing the inherent risks and applying proper risk management techniques is crucial to success in this field.