An interbank market is a trading exchange where the largest banks trade and create the prices of a security directly between themselves. The largest such market, and at the same time the largest market in the world is the currency market better known as the foreign exchange market (FOREX).

Interbank Market vs. Centralized Exchange

Now, in contrast to an interbank market, on a classical centralized exchange, like for example the stock exchange market, all participants trade through one and the same dealer or market maker.

Of course, the stock exchange dealer charges fees and commissions for providing the service of an intermediary in the transactions. By definition, this makes trading on a centralized exchange more expensive than trading on the interbank market.

On the stock exchange, each transaction is recorded with the price and volume it was settled on. Hence, this is the exact reason why there is volume data for the stock market, but never for the foreign exchange market.

On the interbank FX market, each bank or financial institution records its transactions with the other participants on the market and keeps these records private, therefore they are not available to the public. So, even though sometimes you will find volume data for the Forex market, it’s never the true volume of the whole FX market, but rather the volume from one market maker (a bank, dealer, broker etc.).

Note: Volume in the MT4 platform is only a sum of market moves - ticks - during a given candle. Volume in the MT4 does not correspond to a volume of orders made through your retail broker.

How banks are trading and how prices are created on the interbank market

Now, let’s see how the prices are created on the interbank market.

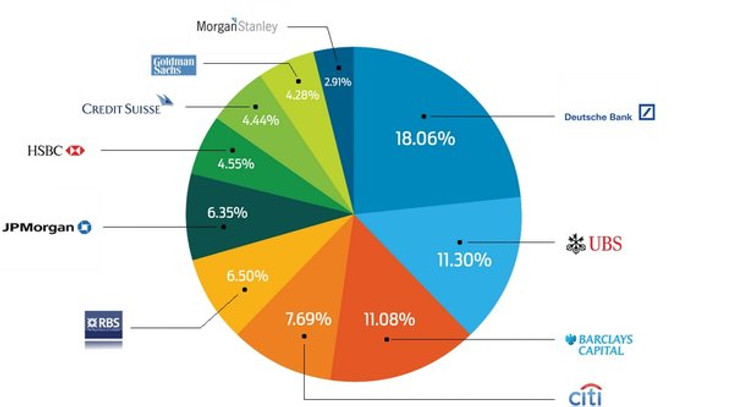

Naturally, most of the time the prices are determined by the largest participants in the foreign exchange market – the world’s top banks. The banks trade on the foreign exchange market either for their own reasons or on behalf of their clients.

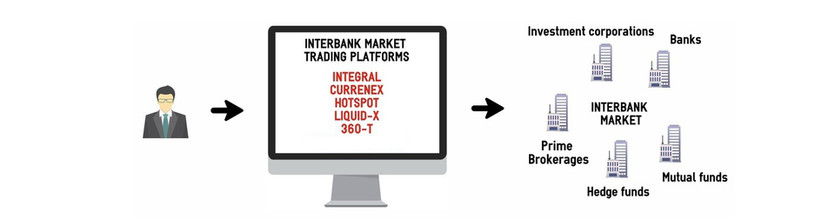

These banks and financial institutions are securely connected to each other through an interbank electronic trading platform. Inside the platform, each bank can see the quoted bid and ask prices for different currencies by the other competitor banks and institutions. Consequently, everyone can buy or sell from everyone else.

You can immediately see how this creates a good competition between the banks to offer and quote the best possible prices they can at the moment.

For example, if bank A, believes that EURUSD will quickly go up then it’s only logical that it will be willing to buy it at a higher price than the other banks. Thus, bank A provides the best price for someone who wants to sell the Euro against the USD.

Of course, it’s not that simple in the real world and there are some capital requirements that each financial institution must meet before it can trade on the interbank market which also determines how it can trade on the interbank market.

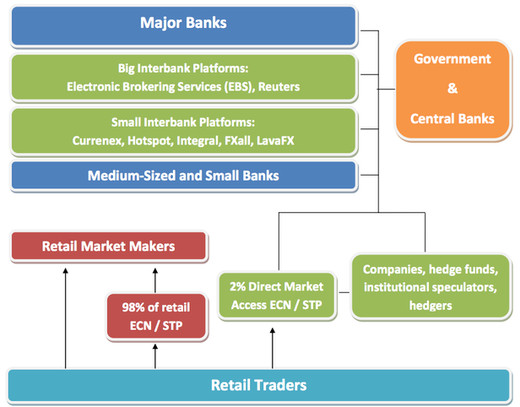

The interbank FX market is hierarchically structured, most importantly by capital, credit access and traded volume of each participant in the market. The top banks in these aspects tend to get better prices, hence the bigger the bank the more superior it will tend to be in these 3 aspects. We can conclude then, that in the FX market the more money you have that much better pricing you will get and that much in a better position you are to make money.

While, yes the interbank market is not regulated by the government or any state authority, the self-regulation of banks and the other participants on the interbank market proves to be highly effective as it allows only the best and most capable financial institutions to trade on this market.

Because there is no intermediary in the FOREX market, transaction costs are much lower and order execution is blazing fast.

Like with everything else, both the interbank market and centralized exchanges have their pros and cons. However, it is primarily the decentralized nature of the FOREX market that makes it so easily available to the small retail investor.

Forex Aggregators

At the end, let’s talk about aggregators in the Fx market.

An aggregator as the name suggests essentially is a sophisticated software solution that aggregates prices from different liquidity providers in the Fx market and makes them available to clients lower on the hierarchy. Usually, these clients are your typical retail Forex broker, through which most of the retail Forex crowd trades with.

Most importantly, an aggregator enables the Forex broker to customize its services according to its needs and to provide highly competitive prices and faster execution to their clients.

For above-average capitalized individuals or high-volume traders, there are Prime Brokerage brokers who provide a direct access to these forex aggregators.