1-Day Trading, also intra-day trading, is one of the most popular trading methods practiced on CFD contracts.

Why is this so?

It is simply because this trading style is one of the few that allows traders to avoid the much unpopular overnight fees and also the usually high margin requirements.

Strategy entry rules

Entering long positions

1) The candle from the previous day is rising

2) the price hits the high of the previous day's candle

Entry into short positions

1) the previous day's candle is falling

2) price hits the low of the previous day's candle

How to trade with the strategy

The basis of the strategy and the most important part is the D1 timeframe, on which the entire procedure can be easily implemented each day. So how to proceed?

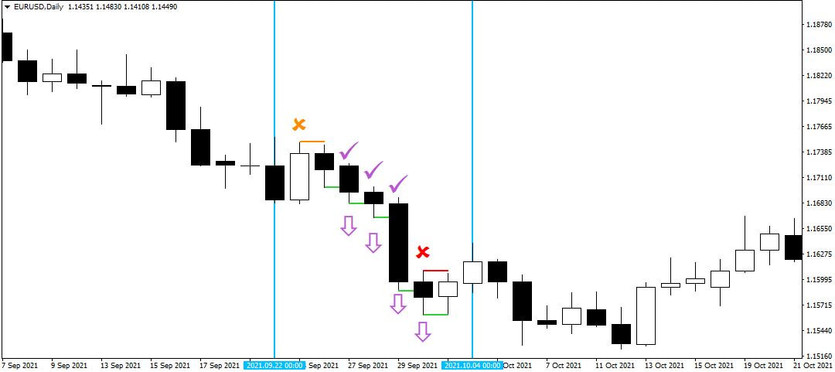

At the moment when the daily candle is closed, it is necessary to check whether the candle has been rising or falling (the candle body is decisive), if on a given day a candle without a body or with a relatively small body has been formed, then in these cases it is usually better not to trade the following day (the market is likely to be out of balance and it is therefore difficult to predict the likely future direction). On the other hand, if the candle has a body, then in the case of a rising candle we place the entry order at its maximum, and in the case of a falling candle it is the minimum. Then, when the entry order is activated during the day, we need to set a stop-loss (can be set already within the entry order), which in turn is placed at the opposite end of the candle than where the entry was located.

Finally, the trade is closed either when the set profit is reached or before the end of the trading day, so that there is no negative overnight charge, which would subsequently reduce the profit or increase the loss.

The success of any 1-Day strategy depends not only on the instrument selected, but also on the current market situation it is in. With an optimal combination of these two factors, you can expect a success rate of around 80% for entries and 60%-70% in the long term.