Aggressive scalping and all trading strategies are the alpha and omega not only in case of trading, but in general for any investment.

Even if someone claims to trade completely randomly, this is not the case, because everyone's goal is to make a profit and therefore randomly opened positions must be closed in profit, i.e. in accordance with certain rules, i.e. with a certain strategy.

Strategy entry rules (example)

Entry into long positions

- Price moves upwards by a certain number of points

Entry into short positions

- price moves down a certain number of points

How to trade with the strategy

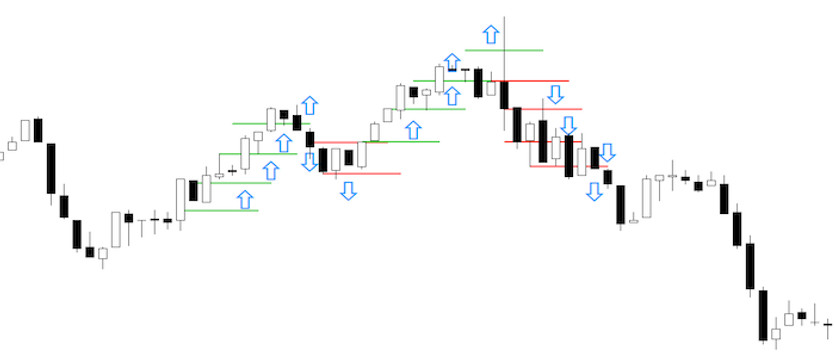

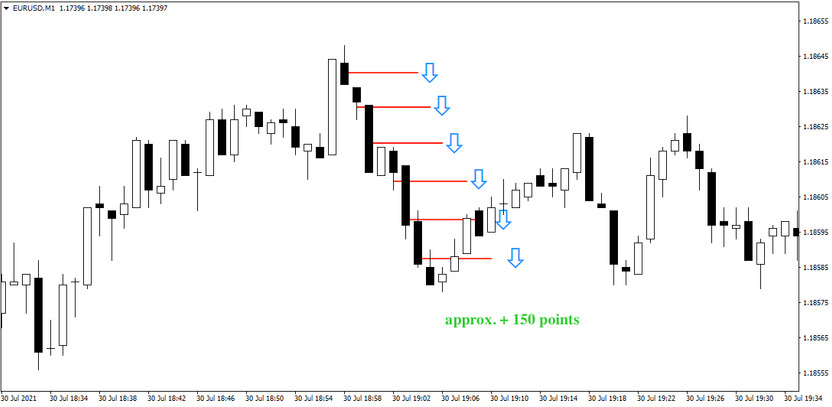

Aggressive scalping is a relatively simple trading strategy in which the trader simply chooses the range over which he or she wants to enter a trading position (in the direction of the move) and then simply makes short and long entries until a predetermined profit is achieved. The chart above/below shows how volumes are gradually increased and entries into other positions are made.

Note: It is of course possible to exit positions gradually, but the main disadvantage of such exits is that the trader partially loses out on the potential extra profit; on the other hand, if the market turns, the potential losses do not reach such a level either.

The success of today's scalping strategy cannot be easily determined. Everything in this case depends on the trader's financial capabilities and mental toughness, which can ultimately cause one to gain where one can hold on and simply lose where one cannot.