Strategies based on trading indicators are very popular among traders, as trading indicators are among the simplest forms of technical analysis in terms of difficulty of processing.

Today we have a strategy based on the Awesome oscillator, with which not only can a decent appreciation be achieved, but this oscillator also hides something worth having always at hand.

Strategy entry rules

Entering long positions

- The indicator bars form above the zero boundary

Entry into short positions

- Indicator bars form below the zero boundary

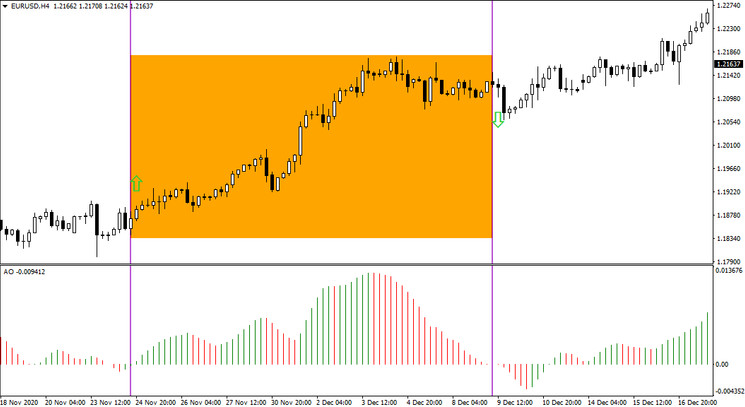

The Awesome Oscillator informs about two important factors, the first of which is the direction of the trend, which the trader recognizes so that the bars of the indicator form either below the zero line (downtrend) or above it (uptrend). The second important factor is the potential preponderance on the buyers' or sellers' side (the higher/lower from zero the tops of the bars are, the higher the probability that there is a significant preponderance on that side and the trend will continue)

Today's strategy is then very simple, it consists in waiting until one side loses the upper hand and it goes to the opposite side. At that point, trading positions are eventually entered (see below - the first vertical line). The Stop-Loss is placed about 50 pips (in case of H4 timeframe) from the entry position and the Take-Profit is not placed here, as the exit in profit occurs at the moment when the prevailing side goes to the opposite side again (see below - the second vertical line), which is a signal that the given trend direction has ended.

With a strategy based on the Awesome Oscillator, which is an essential part of the MetaTrader4 trading platform, it is possible to achieve success rates in the range of 45-65% in the long term.