A large number of traders who already have some experience with Forex are of the opinion that in order to become really successful in this sector, one has to sacrifice not only a lot of effort but also a lot of time.

Of course, this is not true at all, because it always mainly depends on the approach and strategy that traders themselves choose. For example, today's BigFive is a trading strategy that does not require constant observation of charts and price movements, as it works on a weekly basis, which means that we enter at the beginning of the week and, on the contrary, we exit at the end of the week or at the end of some other week. That's it!

Strategy entry rules

Entering long positions

- the market price has risen over the previous week

Entry into short positions

- the market price for the previous week has fallen

Strategy - procedure

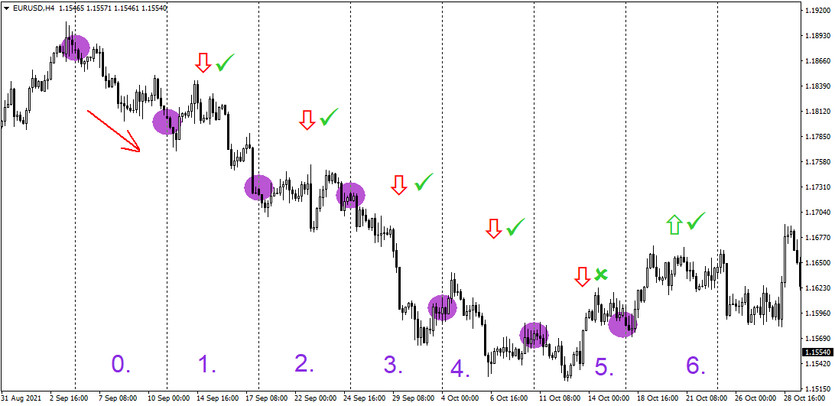

The basic and core element of the BigFive strategy is to determine the direction for the future opening of a trading position. Since the system uses weekly sessions, to determine the direction we only need to compare the opening value of the previous week with its closing value and if there was a decline, then in the next week we enter a short position and if there is an increase, of course, vice versa.

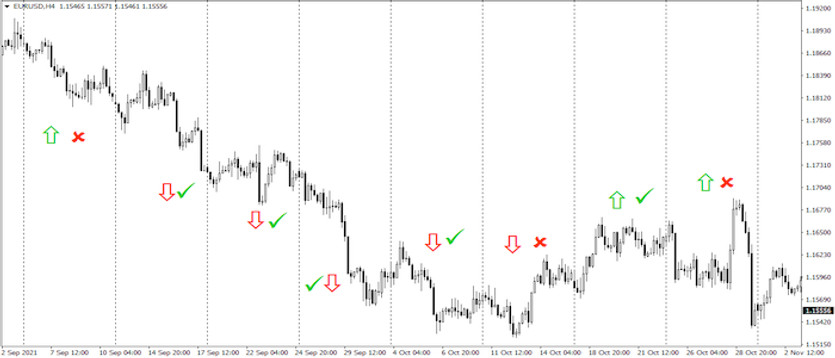

Above you can see a session of four consecutive weeks in which the BigFive strategy was applied. Specifically, the first week (labeled - 1.) served only to analyze the direction (short) in which the entry into the position occurred the second week (2.). Analogously, the same procedure was then followed in the following weeks and, as it turned out in the end, in all cases the market actually fell the following week.

Tip: Positions can be left open for more than one week. On the one hand, this brings with it an increased risk of potential losses, but on the other hand it can also lead to the accumulation of profits from multiple positions, which then accelerates the growth of capital in the trading account.

It is evident from the above session that this strategy can achieve success rates in excess of 50%, but in the long term it is no exception that on many instruments the success rate is well above 66%.