The CSBB strategy is formed on the basis of four classic indicators. Each of them brings some benefit to the functioning of the strategy. One of them determines the main trend, and the rest correct the value of the first one, and form an accurate signal to enter trades. Trade is made on all time intervals, but the most optimal will be the intervals of group H. Currency pairs can also be any.

Strategy indicators

The strategy consists of four basic indicators, the parameters of which remain practically unchanged. However, the parameters of some should be changed for the CSBB strategy to work more correctly.

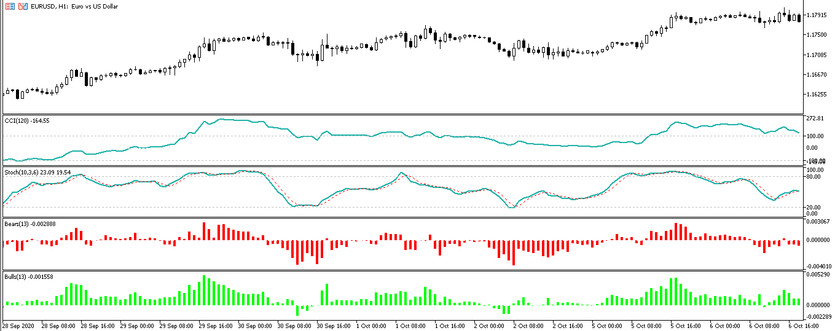

- -CCI - the main indicator of the strategy. The indicator will determine the market trend, and based on its value, one or another trade will be made. The value is set to 120.

- -Stochastic-indicator that will also indicate the market trend and monitor oversold and overbought conditions. The value changes to 10,3,6.

- -Bears- an indicator of a bearish trend. The value of the indicator remains unchanged.

- -Bulls- an indicator of a bullish trend. The value of the indicator remains unchanged.

Also, in the parameters of each indicator included in the strategy, it can be changed the color scheme and width.

Despite the abundance of indicators included in the strategy, making trades will not be difficult. The main rule will be to monitor the values of the CCI and Stochastic indicators. And also, depending on the trade, monitor the Bears and Bulls indicators.

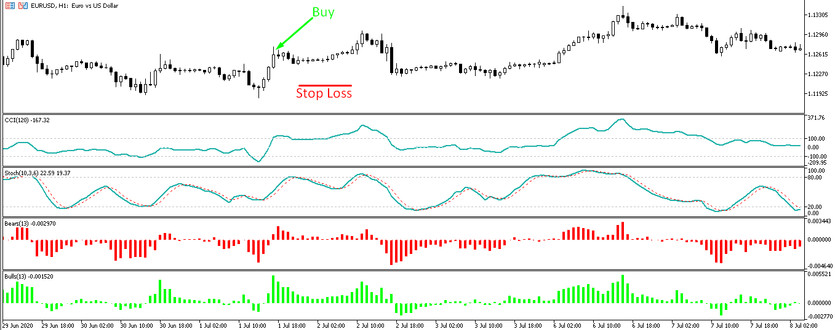

Conditions for Buy trades

- -The CCI indicator line moves upward after crossing level 0. After that, the indicator crosses level 100 and continues to move upward.

- -The Stochastic indicator is also directed upwards, but it is important that it does not cross the level of 80, that is, the overbought zone. If the above conditions are met, then a buy trade can be made, despite the values of the remaining indicators. If the line still crosses the level 80, then it should be waited for the line to drop below this level.

- -The Bulls indicator bars are above the 0 level and have a growth value.

To close a buy trade, the following conditions must be formed:

- - The line of the CCI indicator changes direction and moves down, below the level of 100.

- -The Stochastic indicator is pointing down, or its lines cross the level 80.

- - Bulls indicator bars are below level 0.

The stop loss order is set at a distance of 30 points, and the take profit is 60 points. The trade is transferred to breakeven when passing 30 points in the positive zone.

Conditions for Sell trades

- -The CCI indicator line moves downward after crossing the level 0. After that, the indicator crosses the level -100 and continues to move downward.

- -The Stochastic indicator is also directed down, but it is important that it does not cross the level 20, that is, the oversold zone. If the above conditions are met, then a sell trade can be made, despite the values of the remaining indicators. 20, then it should be waited for the line to rise above this level.

- -The Bulls indicator bars are below level 0 and have a falling value.

To close a sell trade, the following conditions must be formed:

- - The line of the CCI indicator changes direction and moves up, above the level of 100.

- -The Stochastic indicator is pointing up, or its lines cross the level 20.

- - Bulls indicator bars are above level 0.

The stop loss order is set at a distance of 30 points, and the take profit is 60 points. The trade is transferred to breakeven when passing 30 points in the positive zone.

Conclusion

The CSBB trading strategy is based on four classic indicators, so its use will not be difficult and it will suit even beginners. Considering its ease of use, it can be quickly and easily made any trade. And the combination of all indicators, allows to make a trade also profitably. And the totality of the functioning of all indicators allows to make a trade and profitably. Making a trade without a loss will allow both correct money management and practice on a demo account.