An indecisive market means fewer trading opportunities, so it is not at all surprising that this situation is not to the liking of most traders.

However, it should be remembered that there are always two sides to the coin. Therefore, where others do not see the potential, others can literally change something out of nothing. This is also the case with market indecision, which undoubtedly has a lot to offer under certain conditions, and moreover, if a trader learns to look for the right opportunities, then his account can literally start growing at rocket speed.

Strategy entry rules (example)

Entering long positions

- Hitting the high (higher high of the selected candles)

Entering short positions

- Hitting the low (lower low of the selected candles)

How to trade with the strategy

The most important part of how to trade today's strategy is to look for at least two consecutive candles that are characterized by a "small" body and at the same time at least one of them has both wicks, i.e. both the bottom and the top relatively longer. It is candles like these that usually herald that the market has entered an indecisive state, after which a new and particularly strong trend often forms.

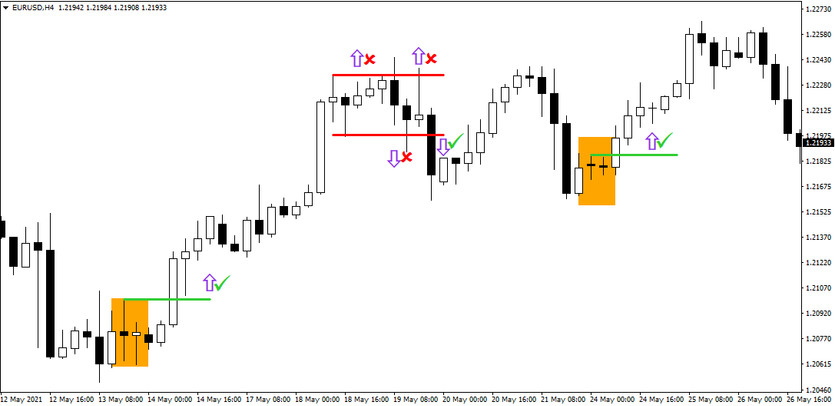

In the chart below, it is possible to see several trading opportunities, where in the first case a set high (entry signal) was hit, after which the market moved in a new direction as expected. In the second case, the market indecision persisted for some time, resulting in several entries. which would probably have ended in a loss (even losses should always be taken into account). The third case, however, again worked exactly as expected and so again here the market would offer traders a very interesting trading opportunity.

With this trading strategy it is possible to achieve success rates in excess of 60%, with the biggest advantage of the strategy being that in the case of profitable trades it is possible to place Take-Profits many times further (multiples) from the entry than Stop-Loss limit orders.