Leonardo Bonacci aka Fibonacci. The Italian mathematician, whose work laid the foundations not only for many historical algorithms, but moreover the sequence with the help of which Fibonacci solved the problem of population growth over time, today influences our great world day by day.

And whether it is mathematics, chemistry, physics or economics, without realising it, Fibonacci sequences can be found everywhere, and of course trading is no exception.

Strategy entry rules

Entering long positions

1) FiboFan plotted rising

2) price hits (from above) one of the Fibo lines

Entry into short positions

1) the plotted FiboFan is falling

2) price hits (from below) one of the Fibo lines

How to trade with the strategy

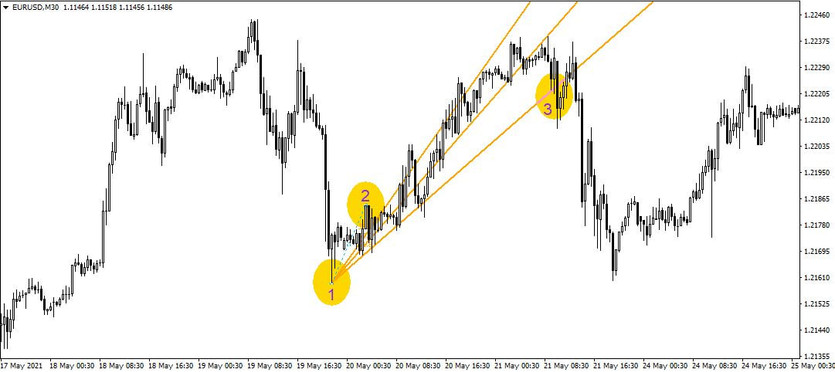

On the chart below, the first incremental minimum and maximum are marked with the help of points 1 and 2, which are always used to plot the Fibonacci fan. Once the Fibo is plotted, then all you have to do is wait for the price to hit one of the lines and enter a trading position. In the context of risk tolerance, it is then ultimately up to each individual where they place their Stop-Losses and Take-Profits, or under what conditions they approach the exit of trading positions.

Caution:

A fan can be considered broken (no longer valid) when the price passes through all lines and closes (below/above - see point 3 on the chart below). Breakouts that occur "shortly" after a Fibo fan is formed should usually be taken with a grain of salt, as many of them do not end up being breakouts at all, but rather are market corrections that just managed to overcome the still very narrow Fibo fan band at the time.

The basic strategy, based on Fibonacci fans, is one of the time-tested and particularly effective trading strategies, which also boasts a considerably high percentage of successful entries, where it can acquire values of over 75%.