Leonardo Pisan, also known as Fibonacci, was a mathematician who lived in the 12th century and advocated the introduction of Arabic numerals instead of the Roman numerals that were widely used at the time. Leonardo realised during his lifetime that, due to their limitations, they could no longer meet the new needs of "modern" mathematics.

Of course, it is also he who came up with the so-called Fibonacci series, which over time found its way into places where no one would have expected it.

Entry rules of the strategy

Entering long positions

- Usually if the market falls by a certain price range

Entering short positions

- usually if the market rises by a certain price range

How to trade with the system

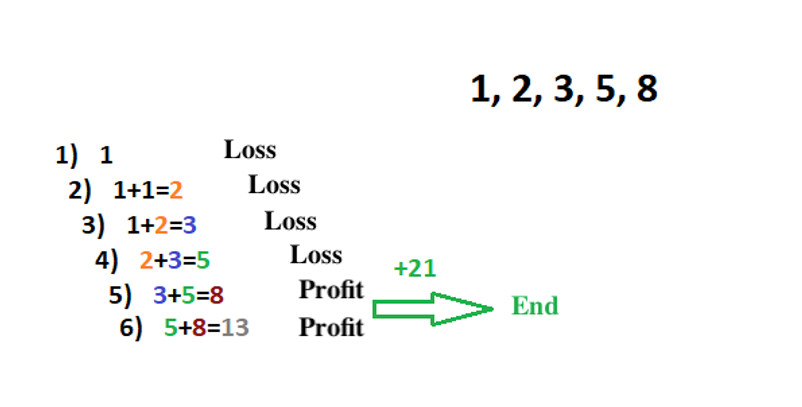

In the picture above, you can see step by step how the Fibonacci sequence is formed, i.e., there is always a sum of two previous values, which then form a new number. The Fibonacci volume system then works very simply, in that each number in the Fibonacci sequence always determines a multiplier by which we multiply the base volume to get the volume for our new position.

So, for example, if there are four consecutive losses and our base volume is determined to be 0.01lot (see figure below), then we enter with a volume of (0.01*1=0.01) for the first position, (0.01*2) for the second, (0.01*3) for the third, (0.01*5) for the fourth, and so it goes until the system generates enough profits to cover all the previous losses.

The Fibonacci system can be seriously claimed to be a trading algorithm that always ends up in profit sooner or later. Unfortunately, it also has to be admitted that its big disadvantage is that in sessions where less capital-equipped traders experience a series of consecutive losses, it tends to be very financially challenging for them to maintain, which is usually why these traders end up losing a lot with it.