Price Action systems are usually very versatile, allowing traders to use them not only across markets and instruments, but also across time frames.

Moreover, big round numbers are one of the real rarities in the case of Price Action, as it is one of the few trading indicators that does not change across timeframes, and every trader, whether a long-term or scalper, always has the same important indicator in front of him.

Strategy entry rules

Entering long positions

1) price passes through some round number level from bottom to top

Entry into short positions

1) price passes through some round number level from top to bottom

How to trade with the strategy

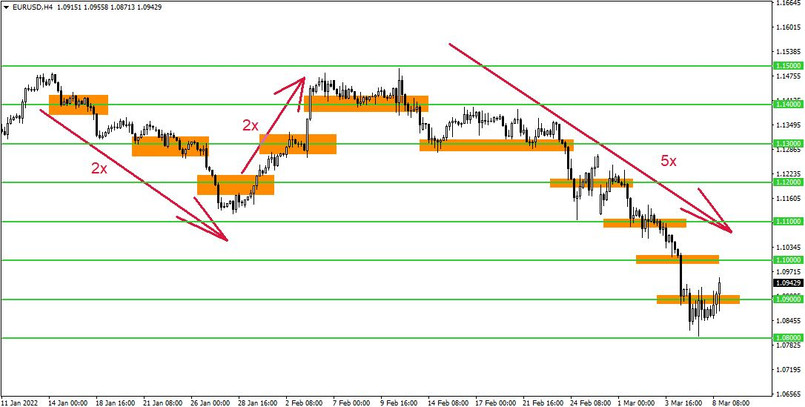

There are several ways to use the strategy, but the most common is to trade in accordance with the current trend situation. This means that the trader waits for the moment when the price hits one of the levels of large round numbers (in the case of EURUSD, these are price levels whose numerical value ends with three zeros => 1.20000, 1.19000, 1.18000, etc.). Once this occurs, then a position is entered in the direction of the hit and is then normally stayed in that position until the market reverses and hits a new higher/lower round number level.

In the figure below, it is possible to see both the points within which the market has hit a given level and also the number (red values) of price zones (range between levels => one zone equals 1000 points) that the market has managed to continuously overcome after the first pass.

The above chart shows that this strategy can not only be very profitable in trend situations, but also has a long-term success rate in the range of 70-80%, which is more than sufficient in terms of long-term sustainability.