Despite the fact that the CCI "Commodity Channel Index" was primarily created for the purposes of the commodity market, where it served as an indicator measuring the relationship between the price of the underlying asset, the moving average and the standard deviation, it has proven over time that it can be just as good a tool for other markets.

The CCI indicator can be used in many ways, but we will only show one of the really successful and popular ones here today.

Strategy entry rules (example)

Entering long positions

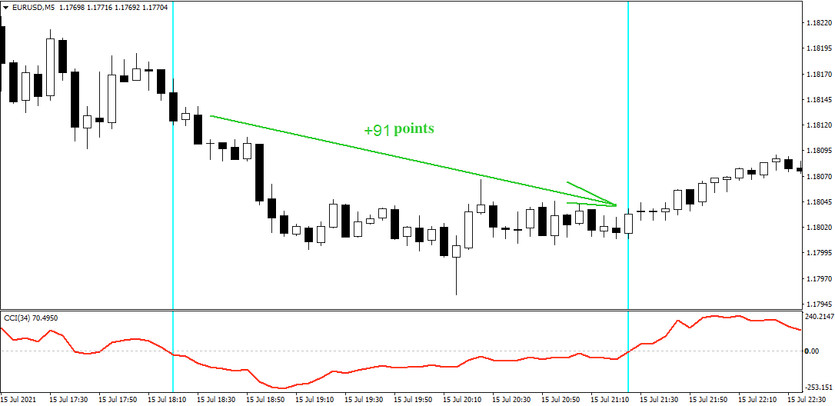

- CCI of period 34 rises above 0

Entry into short positions

- CCI of period 34 falls below 0

How to trade with the strategy

Today's CCI trading strategy is a real pleasure to trade with, as it is not too complicated to understand, but it can achieve impressive success rates over the long term. As we have already mentioned, the strategy is one of the simpler ones and therefore you only need to set the indicator period well (in our case period 34) and then just wait for the CCI value to pass through the zero boundary (see below - vertical line).

With CCI trading it is possible to achieve success rates ranging from 30 to 70% and sometimes even more. The most important thing, which of course ultimately affects the resulting success rate the most, is the appropriate setup and the "right" choice of currency pair.