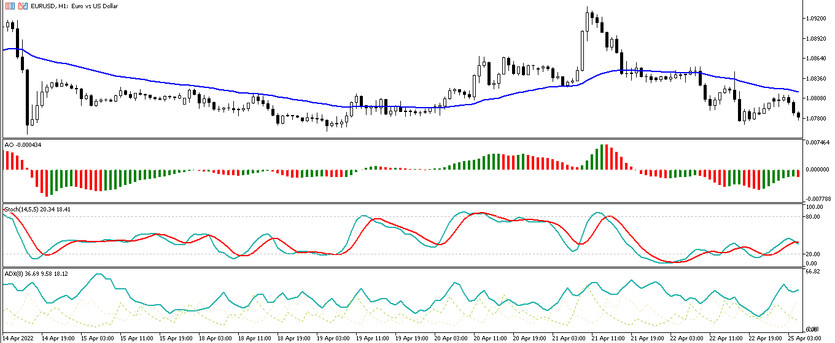

MASA is a trend trading strategy based on the functioning of classic forex indicators. The strategy works great during a trend in the market, and it can also work out of a trend, but the probability of making a profit will not be as great as in a trend. Its application will not be difficult, but while trades promise to be profitable. Trades using this strategy can be made on any timeframe, with any currency pairs.

Strategy indicators

The MASA strategy is based on four standard indicators, so before using this trading strategy, it is recommended to study each indicator included in it.

- -Moving Average (Smoothed) - smoothed moving average applied to the price chart. Period 24 is set.

- -Awesome Oscillator - an oscillator that will accurately determine the entry points to any trades. It is located in the lower chart window. The settings remain unchanged.

- -Stochastic Oscillator-indicator indicating overbought or oversold zones with values of 14.5.5.

- -ADX-indicator that helps to determine the presence of a price trend. The period is set to 8 and an additional level of 35.

Trading with the MASA strategy

Making trades using the MASA indicator is very simple, especially if each indicator is studied, since the conditions for each indicator to complete the trade must match.

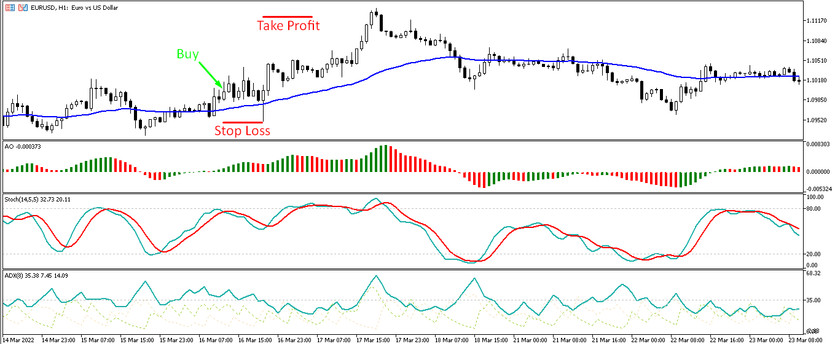

Conditions for Buy trades:

- -The price is above the smoothed moving average.

- -The columns of the Awesome Oscillator indicator have a growth value and are directed upwards.

- - The main line of the Stochastic Oscillator indicator is above the signal line, but has not reached the overbought zone.

- -The main ADX line crosses level 35 from the bottom up. And the additional +DI line is above the -DI line.

If all of the above conditions match, a long position is opened. Stop loss is set at 35 points, and take profit is set at 80 points.

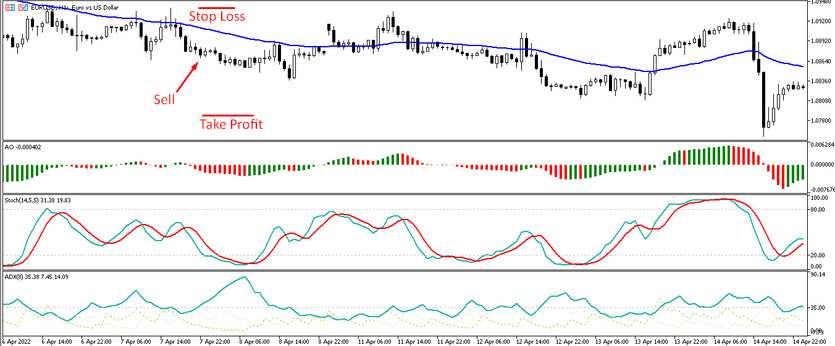

Conditions for Sell trades:

- -The price is below the Smoothed MA.

- -The Awesome Oscillator histogram is heading down and has a falling value.

- -The Stochastic Oscillator line is below the signal line, but does not reach the oversold zone.

- -The main line of the ADX indicator breaks through the level 35 upwards. And the additional line -DI is above the +DI line.

If all of the above conditions match, a short position can be opened. The stop loss order is 35 points, and the take profit order is 80 points.

Conclusion

The MASA strategy is very easy to use, as it is based on basic forex indicators. The main thing is to take into account all the trading rules and ignore extraneous signals, if there is an active trade, and also control the use of money management.