The Gann Grid is a very useful, but unfortunately often largely neglected, business tool, but with which it is possible to do incredible things without exaggeration.

Gann can be used in many ways and its undoubtedly biggest advantage is that it belongs to a group of so-called universal technical indicators that can not only be used across different markets and time frames, but at the same time, when set up correctly, every trader has one and the same graphical output in front of him. So everyone sees the same thing.

Strategy entry rules

Entering long positions

1) Price rises from a lower S/R to a higher one and hits it

Entry into short positions

1) price falls from the higher S/R to the lower one and hits it

How to trade with the strategy

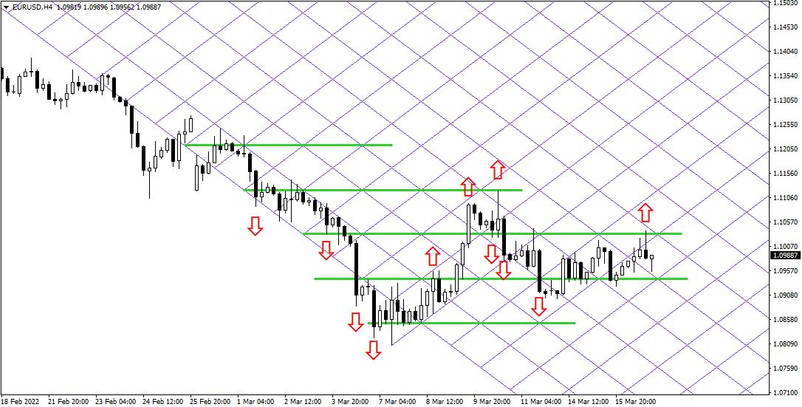

First of all, you need to place a Gann Grid in the chart (see above -> from here you can insert the Gann Grid). The grid should have an ending of about 45 degrees, so that it is formed as best as possible by regular diamonds (a higher angle means a greater distance between the SR levels). As can be seen below, the individual S/R levels are then formed just with the help of the Gann Grid (they are formed by connecting the individual grid nodes) and the advantage of this is that the trader does not have to think at length about whether the level is placed correctly or not.

Entries into trading positions then occur when price goes from one S/R to another and hits it (long entry-when price rises, short entry-when price falls). It is important that the price passes through the entire range (from one S/R to the other) and not just halfway through and then returns (see entries on the chart below - red arrows).

On the other hand, exits from positions in today's strategy normally occur when the price is able to cross at least two plus S/R boundaries (long position - 2 higher S/R, short position - 2 lower S/R). Note a higher number of boundaries means a better RRR, but too many can also mean that the market cannot cross as many boundaries and the strategy can easily become a losing one, so the number of boundaries after which profitable positions are closed needs to be chosen very carefully.

Since the strategy uses the long-term performance of swing moves and the closing of losing positions occurs only after a certain appreciation is reached, it is therefore very difficult to determine the overall success of this strategy. In general, however, profitable positions account for approximately 80-95% of all positions within GGSR, which just goes to show how effective this strategy can be in terms of long-term performance if money-management is set up correctly.