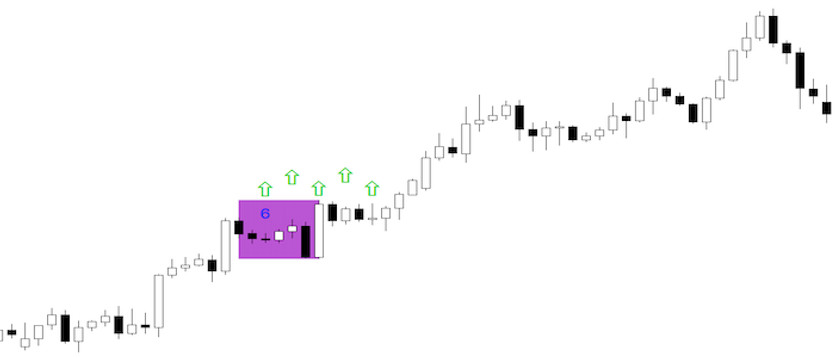

From time to time, not only in forex, but also in other markets, there is a situation when just one single candle can fully cover at least five, but even more candles crossing it.

From a trading point of view, this is often a very important moment when one of the parties has gained the upper hand and can be expected to maintain this trend for at least a few more moments.

Strategy entry rules

Entering long positions

- Creation of a rising candle that fully covers at least 5 preceding candles with its range (High-Low)

- Entry only after the closing of the covering candle

Entry into short positions

- Creating a falling candle that fully covers at least 5 preceding candles with its range (High-Low)

- Entry only after the closing of the covering candle

The above chart shows a situation where the entry conditions were met and after the candle was closed, it was then possible to immediately enter a short trading position (see the chart above marked entry).

Below you can then see the placement of the Stop-Loss, which is normally placed approximately 1/2 way into the body of the candle that served as our entry signal. The Profit-Target is then placed at the discretion of the trader himself, who chooses what ratio between SL and TP to use in his trading.

Note: If the ratio between SL and TP was set to 1:1, then the trade below would end in a profit, if the ratio was higher, then most likely a loss, and therefore it can be really very important and also crucial which ratio the trader ultimately chooses.

With today's simple, but time-tested trading strategy, you can achieve a long-term success rate of over 60% in the markets, which is more than sufficient even if you choose a very conservative 1:1 profit/loss ratio.