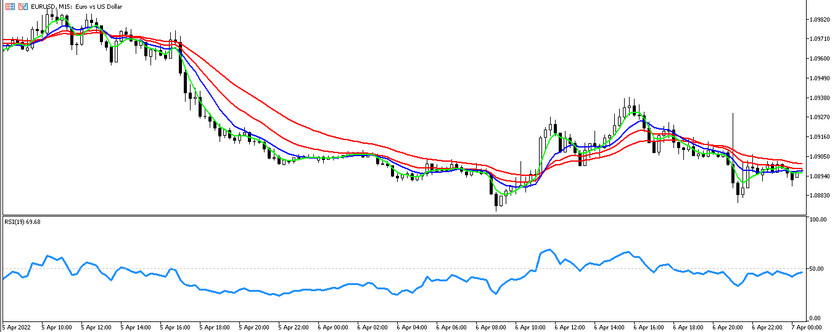

Hallway Forex strategy designed for trading during a short-term trend, that is, using a small time interval. The most optimal would be trading on the M15 chart, but trading on the M30 and H1 intervals also shows good results.

The strategy is based on four moving averages and an oscillator which work well on small intervals. By quickly determining the current trend, the indicators display the optimal point for opening a trade in a certain direction depending on the trend. For more successful trading, it is recommended to choose the right currency pairs, for example, for trading using the Hallway strategy, it is better to use pairs EURUSD or GPBUSD.

Strategy indicators

The Hallway strategy is based on the functioning of classic Forex indicators, which work perfectly both on a small and large timeframe. Four moving averages at a certain intersection will indicate the current trend, and the oscillator will confirm the moving signals.

- -EMA - fast exponential moving average, with a set period of 16.

- -EMA - slow exponential moving average with a period of 30.

- -WMA - slow linearly weighted moving average, the value of which is set to 12.

- -WMA - fast weighted moving average. Its value is 5.

- -RSI-oscillator, the period of which is 19. Also, in the indicator settings, add a level of 50.

Trading with the Hallway strategy

It is very easy to make any trades using the Hallway strategy. During trading, it is important to monitor the intersection of the moving averages, as this is the main signal of the strategy. The values of the RSI indicator are also important, namely, its crossing of level 50.

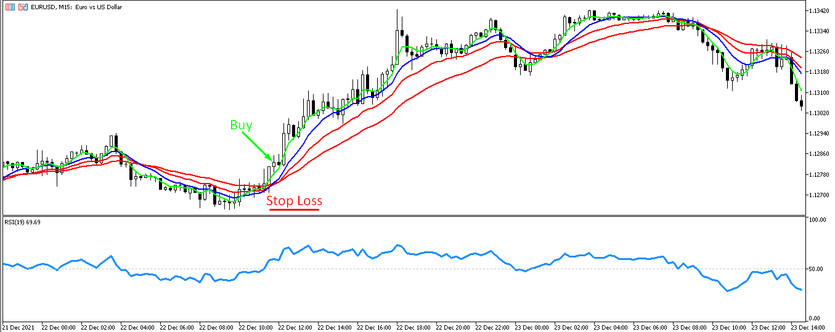

Conditions for Buy trades:

- -Linearly weighted moving averages cross the hallway of exponential moving averages upwards and are above them.

- -At the same time, WMA with a value of 5 is above WMA 12.

- - Exponential moving averages are in order: slow on the bottom and fast on top.

- -The RSI indicator breaks the level of 50 from the bottom up and is above it. This will be a confirmation of the presence of an uptrend in the market.

If the above conditions are met, then a long position can be opened on the next candle. Stop loss is set at the point of a recent local minimum at the point of intersection of the moving averages. Take profit is at the point of intersection of WMA with a value of 5 EMA lines.

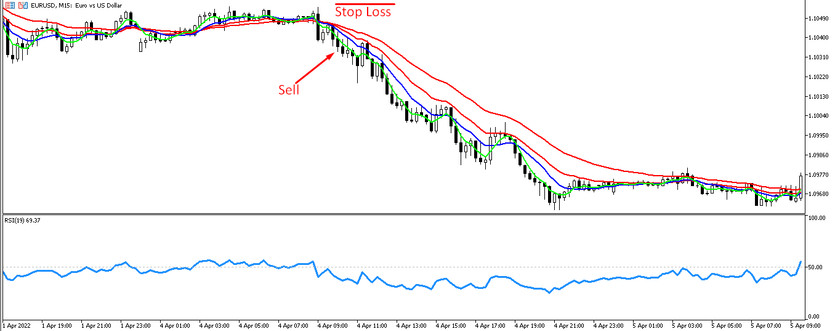

Conditions for Sell trades:

- -The WMA indicator lines cross the EMA lines from top to bottom, that is, they are below them.

- -The fast moving WMA is below the others.

- - EMA 30 is higher than EMA 16.

- -The RSI indicator line crosses its level 50 from top to bottom.

When these conditions are combined, a sell trade can be opened. A stop loss order should be placed at the point of a recent local maximum, when the moving averages cross. Take profit is set when WMA 5 crosses one of the exponential moving averages.

Conclusion

The Hallway strategy is perfect for short-term and fast trading. Indicators as part of the strategy form a clear signal to open or close positions. It is only important to remember that it should be traded during the daytime without postponing strategy signals. Also, the strategy may be lagging due to work moving averages, which do not predict the future trend, but follow the current one.