Do you like trading with trend lines but often wonder whether the lines you have drawn are correct or not? Then we bring you a solution that will take these worries away completely.

Inverse Lines is a revolutionary new strategy that, thanks to its stability over time, does not require additional redrawing, which, as you can see, is a nightmare for many traders.

Strategy entry rules

Entering long positions

- when the market passes through the downtrend line

Entering short positions

- when the market passes through a rising line

Strategy - procedure

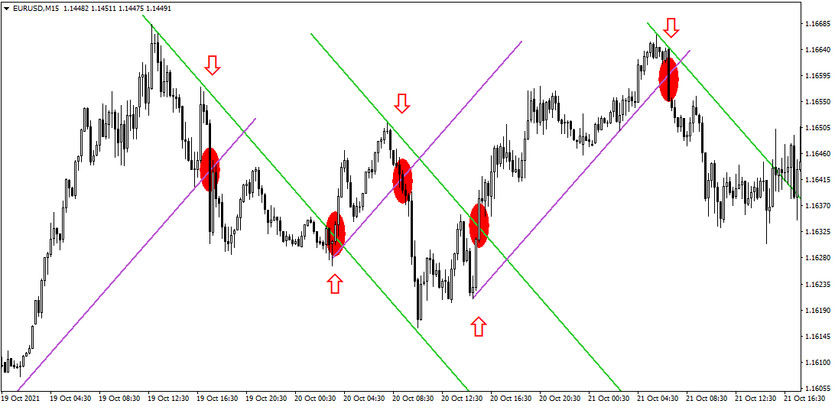

First of all, you need to create inversion lines, which are literally the most important element in today's strategy. Now you may be wondering how to do this, but don't worry, it's really not that difficult. The first thing you need to do is to create any trend line within the chart, but one that will neither rise/fall too fast nor too slow (see the purple line chart above - point 1). Next, you need to create a rectangle through whose corners (top left and bottom right, or top right and bottom left) the line you created will pass (see point2 - red rectangle). Now we just need to create an inverse line by connecting the remaining two free corners of the rectangle with the new line (see point 3 above - green line).

When we have all this ready, then we can move on to the actual trading. This is done by, for example, setting up a downtrend (see the first green line on the chart below - the line we have created with an unchanged slope), and this is valid until the price goes up through it. When this happens (see below - the second red ellipse), then it is possible to enter a long trade and at the same time move the purple line we created, the beginning of which we place at the last support located before the mentioned intervention. Analogously, the opposite is then done in the case of a breakthrough the "new" purple line (see further line placement on the chart below).

In the case of today's strategy, it is difficult to determine the long-term success rate because it depends not only on the market where the strategy is applied but also on the aptly chosen slope of the inversion lines, which can affect the resulting success rate by tens of percent.