There is no doubt that candles and their formations are the cornerstones of modern trading, and it is no wonder that there are a huge number of ways to trade them.

And given the popularity of the formations, it would be a shame not to mention some of them here, and for today we have chosen a lesser-known one that has surprised many a trader in the past with its results.

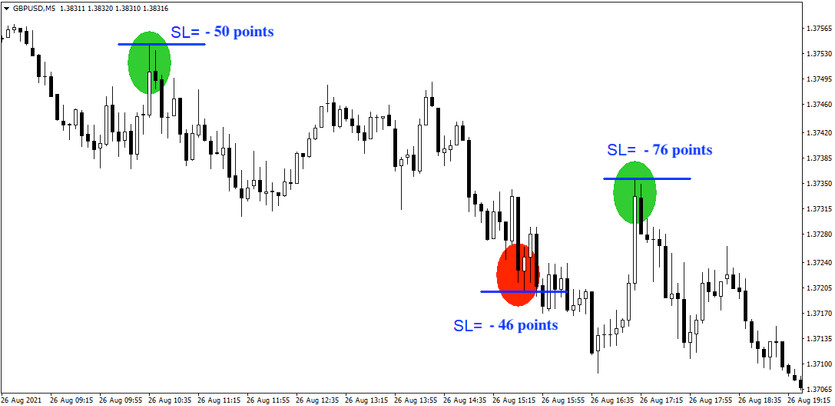

Strategy entry rules (example)

Entering long positions

- two consecutive candles have a "longer" bottom wick

- the end of the body of the first candle is at the level of the beginning of the body of the second candle (there is no gap)

- the first candle is descending, the second is ascending

Entry into short positions

- two consecutive candles have a "longer" upper wick

- the end of the body of the first candle is at the level of the beginning of the body of the second candle (there is no gap)

- the first candle is ascending, the second descending

How to trade with the strategy

As with other candlestick formations, you only need to wait for the moment when the entry rules are met (see above) and then just enter the trade, set the Stop-Loss (placed at the end of the higher/lower wick - see below) and determine the position where you plan to exit the trade profitably (this is an individual determination).

The knot knot formation offers a significant amount of trading opportunities across time frames and can thus be used by almost every trader. However, its greatest advantage is not its universal use, but the fact that it achieves a long-term success rate of around 70% and usually risks very little capital.