Gold, a commodity that some can't get enough of, while others can't stand it. Whether one falls into one group or the other, the fact is that the value of gold has increased by more than 4500% in the last 50 years.

Thus, gold is not only one of the best savings for retirement, but it is also an item that has always held its value so far, even in the toughest of times. And so, even for all this, there can be no doubt that gold is, and hopefully will be for a long time to come, an investment that never disappoints.

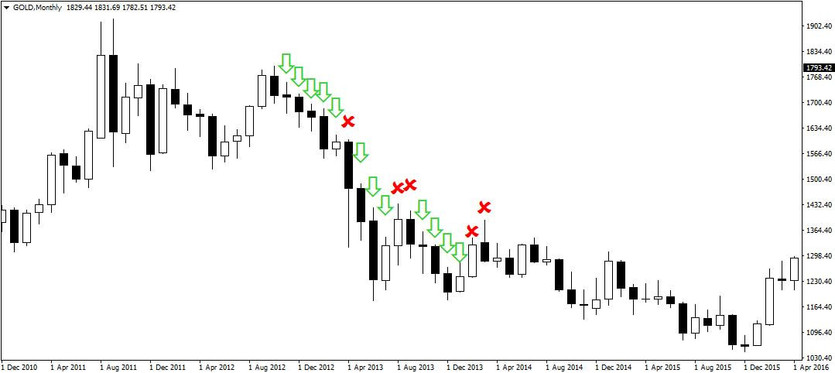

Strategy entry rules

Entering long positions

1) the previous candle is falling

2) when it has fallen by a certain level

Exiting positions

1) when the total average profit from all open positions exceeds a certain percentage

2) when the profit from a position exceeds a certain percentage

3) in retirement

How to trade with the strategy

The most important thing with long term strategies is to follow the concept of longevity, but this is often a problem for many traders as they are usually only interested in the "quick/easy" money. Therefore, with long-term trading, everyone must take into account that these are investments not for hours, not for days, but for months and years. Therefore, the simplest and most widely used strategy is to invest regularly (for example, always at the beginning of a new month), but from the point of view of profitability, it is better to improve such a strategy a little more, so that the trader, for example, invests only when the price has fallen in the last month. Although it may not seem like it, in the long run, such prudent investing can earn 50% or more, and that is after all that traders are all about.

Why invest in gold?

Gold is one of those commodities that are limited in quantity and, without seeming to be, it is not found in almost every electronic item today. This fact adds to its value, of course, but in addition, there is an even stronger role played by the nature of modern money, which is known to lose value over time as banks keep printing it. This is also the main reason why gold can be expected to keep getting stronger against currencies, as the purchasing power of currencies, thanks to the constant increase in wages and new issuance, will keep getting weaker (unless the financial system changes).

Can we expect the same rapid rise in the price of gold in the next 20 years?

Given the above nature of the financial system, it is very likely.

Long-term trading is a specific trading method where the primary goal is usually not the number of successful trades, but the "average" profitability. This means that the percentage of success is somewhat meaningless here, and therefore this value is not usually given for such strategies.