Moving averages and their use in modern trading have literally become something that few even the most experienced traders can do without today.

Due to this fact, over time, a strategy called MA-Develope was created, which combines the aforementioned moving averages and Envelope lines, thus giving the trader not only a constant overview of the current trend setup, but also the current distance of the price from the current entry position.

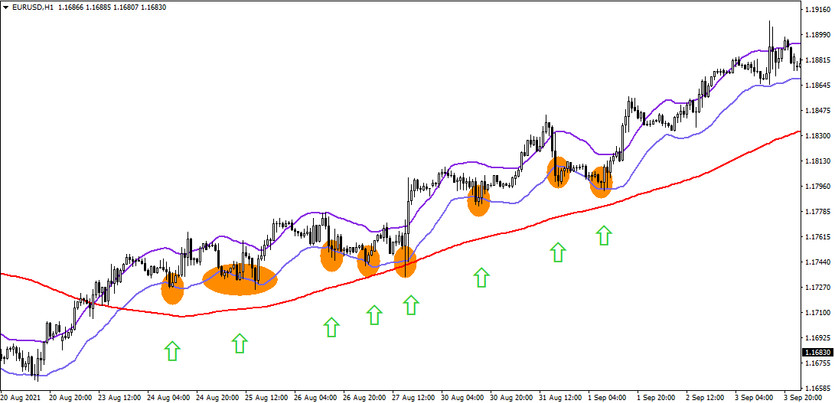

Strategy entry rules

Entering long positions

- Moving average moves below both envelope lines

- price hits the lower envelope line

Entry into short positions

- moving average moves above both envelope lines

- price hits the upper envelope line

Strategy - procedure

Above you can see the specific setup of both indicators that was used in the following trading demo below. The basis of MA-Develope is the use of the moving average together with the Envelope indicator, and to increase the success rate, trading positions are entered only when the moving average is either above or below both envelope lines (it must not be between them or touching one of them).

If it does meet this, then one need only wait until it meets one of the above entry rules, based on which one can immediately enter a trading position in that direction.

Notice:

Entries should be made immediately after the price hits the envelope line, as any longer delay may mean that the trade may end in a loss instead of a profit.

If the market gets into a trend, the success rate of this strategy can climb to over a respectable 85%. However, in the long run, and depending on the instrument chosen, a success rate of about 10%-20% lower can be expected.