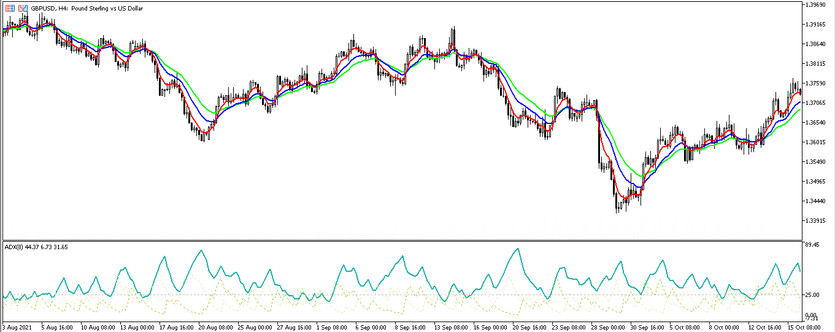

MADX is a trading strategy based on standard Forex indicators, namely ADX and three exponential moving averages. The strategy is based on identifying large trend movements for the subsequent opening of certain positions. The strategy is designed to use the GPBUSD currency pair, however, the possibility is not denied using this strategy with other pairs, while the indicator settings should be adapted to the selected pair. The optimal timeframe for this strategy is H4.

Strategy indicators

Trading with the MADX strategy will be very easy due to the fact that it includes commonly used standard indicators.

- -EMA (5) is a fast exponential moving average with a period of 5.

- -EMA (13) - medium exponential moving average with a value of 13.

- -EMA (21) - slow exponential moving average with a selected period of 21.

- -ADX-indicator for determining the strength of the trend, the period of which is equal to 8, also in the indicator settings, add a level of 25.

Trading with the MADX strategy

Due to the combination of the simplest, but at the same time effective indicators in the MADX strategy, it creates the possibility of profitable trading. The main signal to open positions will be a certain intersection and location of exponential moving averages. If it is opened a buy trade, the lines should be in the order: EMA (5) - top, EMA (13) - below EMA (5), and below - EMA (21), and accordingly, when it is opened short positions, the location of these lines should be reversed. After combining this order, it should be paid attention to the values of the ADX indicator.

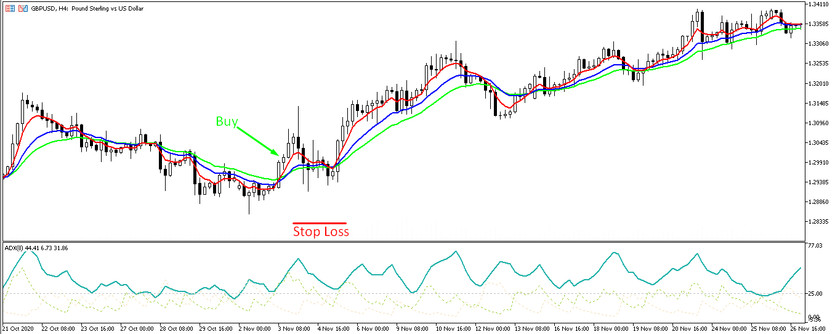

Conditions for Buy trades:

- -The main line of the ADX indicator crosses the level 25 and is above it.

- -The indicator line ADX +D is above the -D line.

- -The EMA (5) line is above the EMA (21) line, and between them there should be an EMA (13) line.

- -A certain candle, crossing the EMA (21), should close above it.

If all of the above conditions match, then a long position can be opened on the next, after the signal candle. The trade should be closed after the formation of a reverse intersection. A stop loss order is placed in the amount of 60-70 points, while the primary take profit is 500 points. After passing 95 points in the positive zone, the trade is transferred to breakeven.

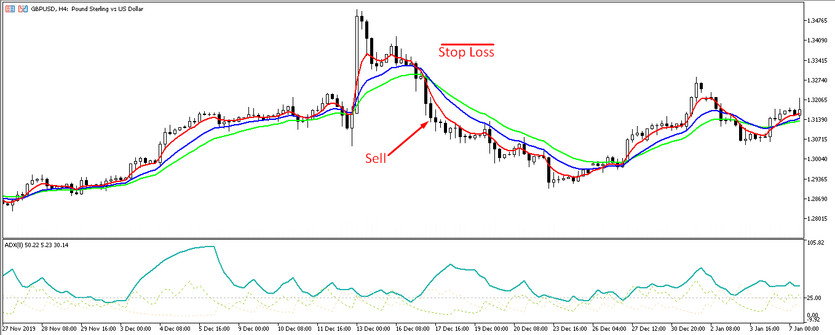

Conditions for Sell trades:

- -The main ADX line breaks through level 25 and is above it.

- -At the same time, its signal line -D is higher than its line +D.

- - Exponential moving averages are arranged in order: slow - on top, medium - below it and fast - below.

- -A certain candle, after crossing with a slow moving average, closed below it.

After receiving a combination of these conditions, a short position can be opened. A sell trade should be closed after the reverse intersection of the moving averages. Stop loss is set at 60-70 points, and take profit is 500. The trade should be transferred to breakeven after passing 95 points in the negative zone.

Conclusion

The MADX strategy is a good example of successful trading when determining a strong trend movement. When making trades, it should be taken into account the currency pair, after choosing which it should be correctly configured the parameters of the indicators. It is also recommended to use a demo account until fully studying the scheme of the system.