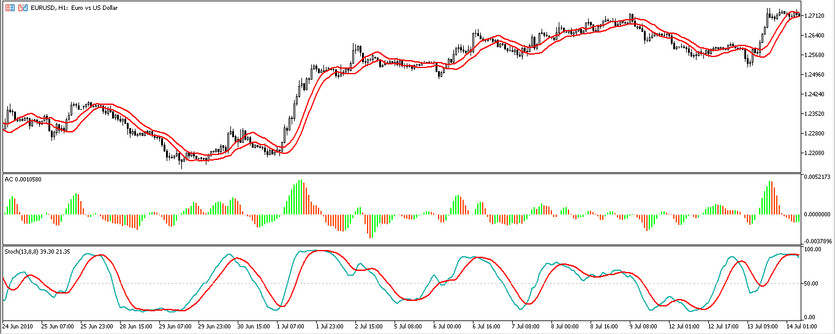

MMSA is a simple and at the same time effective strategy, the signals of which will be quite easy to identify. It is based on the functioning of standard Forex indicators, so it can be used even by beginners. The strategy is suitable for use with any currency pairs, however, the strategy shows more effective results when using pairs with high volatility. Recommended timeframe is H1.

Strategy indicators

The MMSA strategy is based on four standard indicators. The use of the strategy will be simplified by a preliminary study of all the indicators included in its composition.

- -SMA (10) - simple moving average with a period of 10, the calculations of which will be applied to the Low price.

- -SMA (10) - simple moving average, the period of which is 10. The calculations should be applied to the High price.

- -Stochastic Oscillator-indicator, the values of which are set to 13,8,8. At the same time, a level of 50 should be added in the indicator settings.

- -Accelerator Oscillator - an indicator of acceleration or deceleration. The indicator has no settings.

Trading with the MMSA strategy

Trades using this strategy will be made depending on the readings of all indicators. When certain conditions are combined, a long or short position can be opened. It should be borne in mind that when opening a certain trade, another cannot be opened.

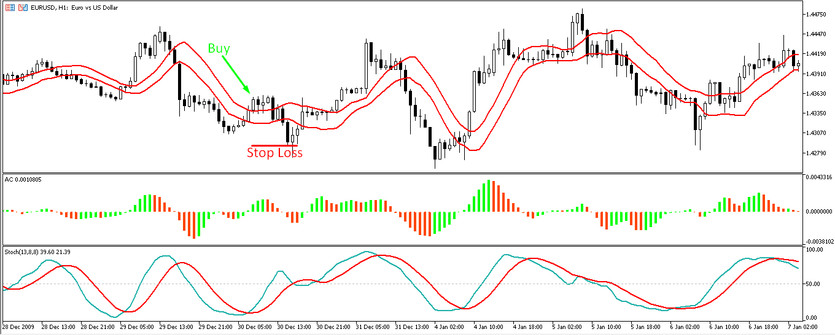

Conditions for Buy trades:

- -The candlestick closes above the SMA, the calculation of which is applied to the High price.

- - The main line of the Stochastic Oscillator indicator is above the signal line, while both lines are below the level of 50.

- -The histogram of the Accelerator Oscillator indicator is directed upwards and has a growth value.

If all of the above conditions are combined, a long position can be opened. A stop loss order should be placed in the amount of 30-40 points. A buy trade should be closed after two columns of the Accelerator Oscillator indicator have a falling value.

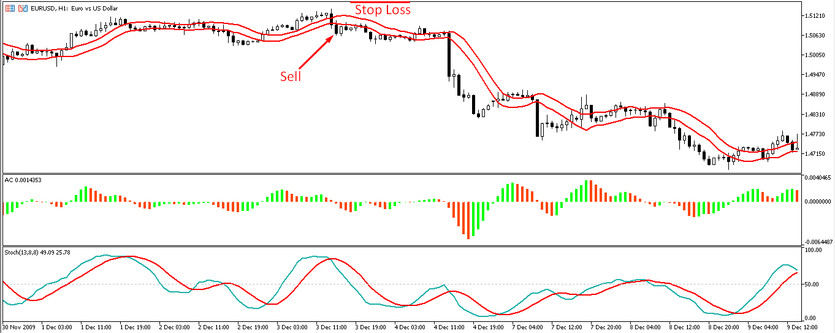

Conditions for Sell trades:

- -Candlestick on the price chart should close below the SMA line, settling at the Low price.

- -The lines of the Stochastic Oscillator indicator break through the level 50 and are above it. In this case, the signal line should be above its main line.

- -The columns of the Accelerator Oscillator indicator are directed downwards and have a fall value.

If all of the above conditions match on a certain candle, then a sell trade is opened. The protective stop loss is 30-40 points. A sell trade should be closed after two columns of the Accelerator Oscillator indicator have a growth value.

Conclusion

The MMSA strategy is very easy to use, but at the same time it is an excellent assistant for effective trading. Its signals are very clear and therefore any trade is made with great accuracy. However, it is still recommended to practice on a demo account before using the strategy on a real deposit.