Trading strategies are certainly the alpha-omega to success, but most of the best ones require a significant amount of effort and time, which unfortunately some traders don't have to spare.

Therefore, not only for those for whom time is balanced by gold, but also for others who are more inclined to invest for the long term, there is a unique monthly strategy that is not only not very time consuming, but also, with the right choice of trading volume, relatively low risk.

Strategy entry rules

Entering long positions

- The current month's opening price is lower than the previous month's opening price

Entry into short positions

- the current month's opening price is higher than the previous month's opening price

How to trade with the strategy

In the case of today's strategy it is very important to have both the period separators visible (located in the settings - see picture above) and also the daily timeframe activated, thanks to which the separators are always generated at the beginning of a new month and the trader can never make a mistake.

If the trading platform is prepared in this way, then we only need to wait for the first trading day of each month and if the price has fallen compared to the previous month (opening price of the first day), we enter a long trading position, and vice versa if it has risen, then we sell.

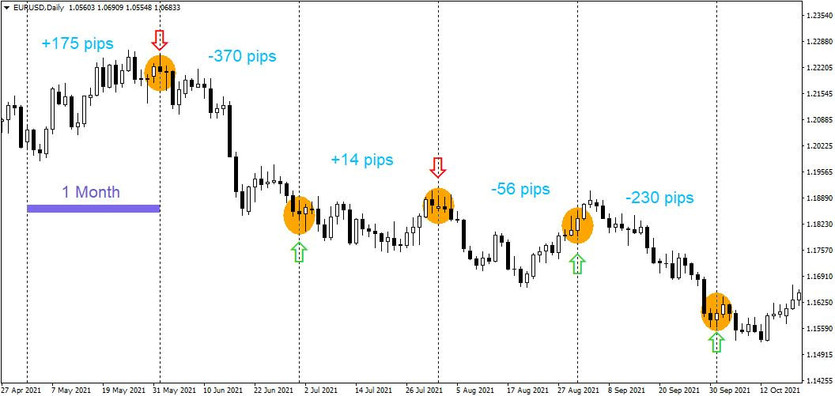

In the chart below you can see one of the trading sessions in which today's monthly strategy was used. As can be seen, first there was a short entry, followed by a long entry (in case there is a simultaneous holding of a short and a long position of the same volume, it is better to close-out these positions completely, as they usually bring us only costs in the form of swaps and no additional profit). Subsequently, the market repeated the short followed by the long (so here again the positions were zeroed out and a profit was recorded on the selling position), and in the last stage there was one more purchase.

In the case of Forex, this trading strategy can usually achieve more than 90% success rate within one year, which is due to the fact that most of the markets move sideways in the long term, so after the upswings there are usually downswings and vice versa.