Fibonacci's mathematical procedures and sequences have laid the foundations for many sciences and teachings across various disciplines, including, of course, those related to the financial sector, such as the much-known professional trading.

There are countless Fibo systems, but the one we present here has one great advantage over the others, namely that its stop-losses are usually so small that one profitable trade can wipe out several losing ones.

Strategy entry rules

Entering long positions

1)Fibonacci Rising

2)Price hits one of the Fibo levels (100, 161.8, 200)

Entry into short positions

1)Declining Fibonacci

2)Price hits one of the Fibo levels (100, 161.8, 200)

How to trade with the strategy

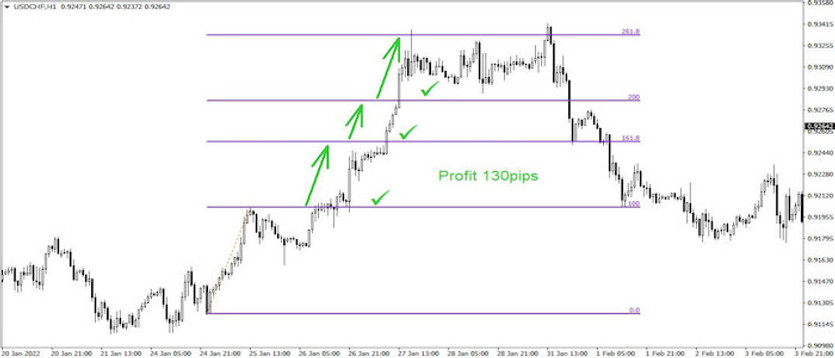

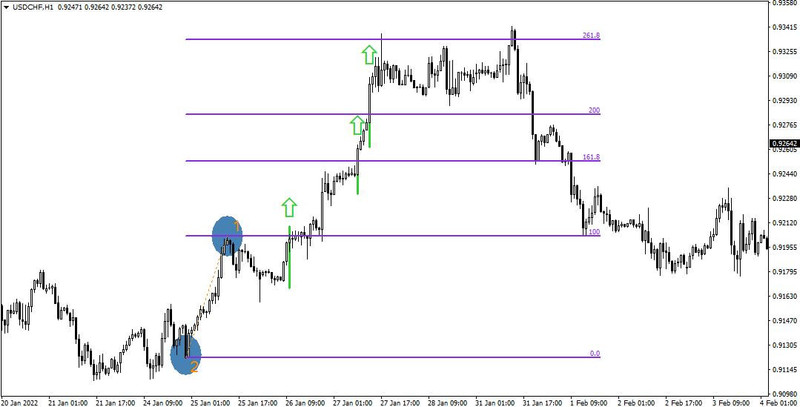

Firstly, it is necessary to insert the Fibonacci levels correctly, which is done by pulling from the youngest bottom to the preceding top (in the case of a falling Fibo), or vice versa, i.e. from the youngest top to the preceding bottom (in the case of a rising Fibo - see picture above).

When plotted correctly, the appropriate levels are then automatically created, of which this strategy only works with the 100, 161.8 and 200 levels. The other levels can be removed from the chart if desired. And now it is only necessary to wait for the moment of hitting one of the mentioned levels and if this happens, then the entry in the direction of the hit is immediately executed (see below - hits marked with green verticals)

Stop-Losses are normally placed at the level of the minimum of the candle that preceded the candle that hit the Fibo level.

This breakthrough Fibo strategy is one of the highly successful ones and can achieve success rates in the range of 70-85% on Forex, with the best results in the case of trending instruments, where it can be assumed that their long-term success rate will not fall below 80%.