Swing strategies take many forms and can be used in so many ways that it is almost impossible to count them today.

Pul&Pul also belongs to a certain type of swing strategy, but it does not primarily use extreme short-term deviations, i.e. peaks and troughs, but is based on moving averages that greatly increase the probability of long-term success.

Strategy entry rules

Entering long positions

- Creating a Pul&Pul line from a rising session

- Price hits the Pul&Pul line

Entry into short positions

- creating a Pul&Pul line from a falling session

- price hits the Pul&Pul line

How to trade with the strategy

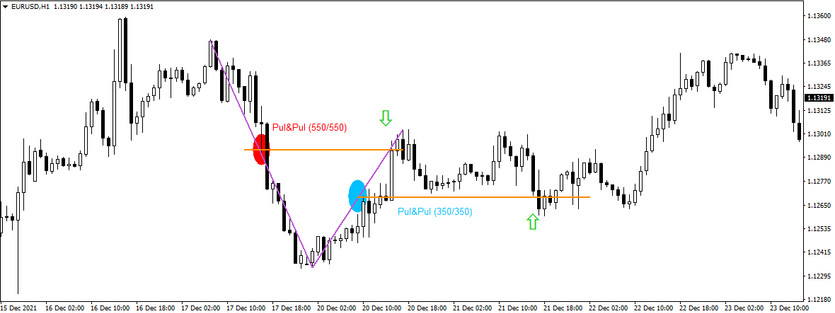

First of all, you need to find out how much change occurred in the market during the last swing up/down (range from top to bottom - purple line above->110pips). After that, you simply need to create a Pul&Pul line about halfway through the bounce (orange line above - 55pips from the top/bottom), which serves as a bounce boundary and also an entry level (when hit - enter the trading position against the direction of the hit and exit the previous position). In this way, it is possible to either follow individual positions over and over again, or to accumulate positions (positions in the same direction) to gain even higher potential appreciation.

Pul&Pul is a highly versatile trading strategy that can be used across a variety of instruments and time frames. Success rates typically range from 55-75%