The candle formation is a first-class technical analysis tool that can be used not only across different markets and time frames, but in addition, it is also a very useful tool in both turbulent and calm times.

Six Identical Bodies, a formation that can predict moments when the market is depleted in one direction and mobilizing forces in the opposite direction.

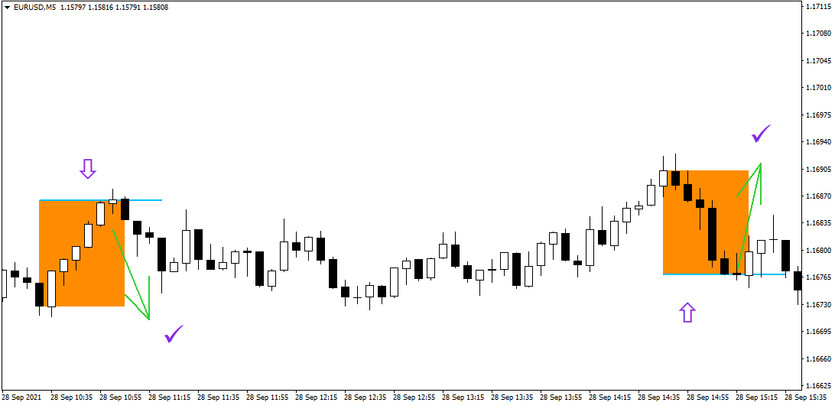

Strategy entry rules (example)

Entering long positions

- Formation of six consecutive descending candles

Entry into short positions

- Creating six consecutive rising candles

How to trade with the strategy

Six Identical Bodies strategy uses a combination of the decreasing probability of not forming another rising/falling candle in a series and the factor of fading trend strength over time, which in turn increases the probability that the market will at least oscillate in the near term and the newly opened position will become profitable.

All that is needed in the case of today's strategy is to wait for the market to form five consecutive falling/rising candles on the M5 chart (a candle without a body breaks the series, and thus one has to wait for the whole series again) and then when the next candle is opened, one has to enter a trading position in the opposite direction.

The SL/TP setting is entirely up to the decision of each individual. In general, however, the SL distance from the entry should not exceed the entry distance from the opening position of the first candle in the series.

Six Identical Bodies trading strategy is particularly suitable for use in Forex, where it can achieve a long-term success rate of between 60 and 65 percent.