The AntiAlligator Trend Waves trading strategy is a trading algorithm that is based on the functioning of two effective indicators, the way of which differs from other trend indicators, but this does not make the strategy difficult to use, and it is even suitable for beginners. Indicators functioning with each other define the direction of the current trend, which in turn allows finding the optimal moment to open a trade. Thus, a trade can be opened on a candle confirmed by both indicators.

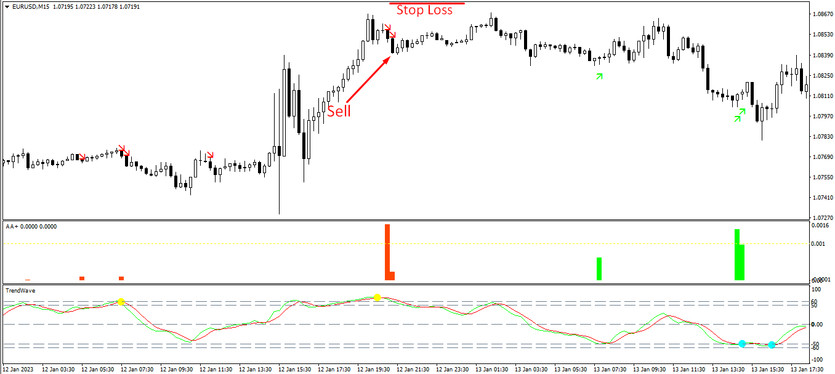

The AntiAlligator Trend Waves strategy is used exclusively on small timeframes, the best of which is M15, and the currency pair is EURUSD.

Strategy indicators

- AntiAlligator - trend trading indicator. Input parameters do not change, that is, Jaws Period 13, Jaws Shift 8, Teeth Period 8, Teeth Shift 5, Lips Period 5, Lips Shift 2. Moving average type -2, price type -4. At the same time a signal level of 0.001 should also be added.

- Trend Waves - indicator with a period of 10, and a period of both moving averages of 21.It should be also added levels: -50, 50, -60 and 60.

Trading with the AntiAlligator strategy

The AntiAlligator Trend Waves trading strategy is very easy to use. To open a certain trade, it should be waited for the full combination of conditions. To do this, it is needed to take into account the formation of AntiAlligator columns and arrows and the intersection of Trend Waves lines. In this case, it should be also taken into account the location of the indicators relative to their signal levels. Thus, a buy trade can be opened when an uptrend is detected, and a sell trade can be opened when a downtrend is detected. When the trend changes, that is, when opposite conditions appear from at least one of the indicators, the trade can be closed.

Conditions for Buy trades:

- The lines of the TrendWave indicator intersect so that the fast one is higher than the slow one and show a point at the place of intersection with a growth value below the level of -50.

- AntiAlligator shows at least two bars above the 0.001 level with a growth value on the same candle.

Upon receipt of such a combination of conditions on the candle that after the signal, a buy trade can be opened. Stop loss is set at the point of a recent local extremum. The trade should be closed upon receipt of reverse conditions from at least one indicator. This will indicate a possible change in the current uptrend, which will allow considering trading in the opposite direction to the current one.

Conditions for Sell trades:

- The TrendWave indicator shows on the chart a point with a falling value above level 50 at the place where the lines cross.

- AntiAlligator forms at least two columns with a growth value above the 0.01 level on the same candle.

Upon receipt of such conditions on a candle, which, after the signal, a short position can be opened, due to the presence of a downtrend in the market. Stop loss is set at the point of a recent local extremum. Such a position should be closed after at least one of the indicators indicates a change in the current trend, that is, it gives a reverse signal. At this moment, it can be considered opening new trades.

Conclusion

The AntiAlligator Trend Waves strategy is very effective and original, since the method of using the indicator does not resemble others. To be able to use the indicator correctly and strengthen general trading skills, preliminary practice on a demo account is recommended, as well as a separate study of the method of functioning of the indicators included in it.

You may also be interested The DeMarker MA trading strategy