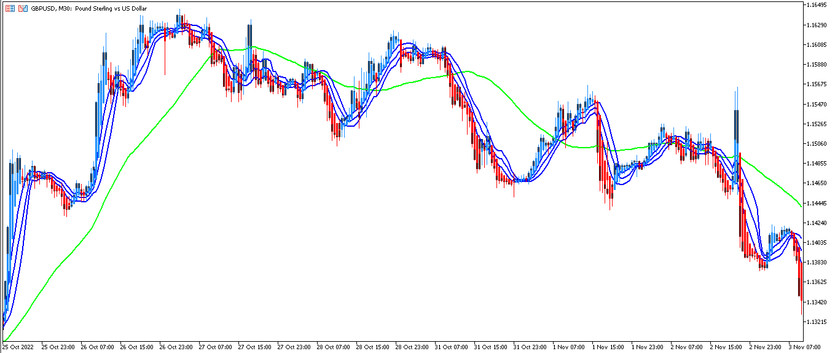

The BB Heiken Ashi trading strategy is used for trend trading. It is based on the functioning of three indicators included in the standard forex set. The interaction of these indicators has formed a very effective strategy, the signals of which are very accurate due to confirmation by several indicators. The strategy is used in trading directly to determine the current trend and trading in its direction. A candle, on which all the signals included in the strategy of indicators coincide, is considered a signal one, and a position can be opened on it, confirmed by the presence of a certain trend.

The BB Heiken Ashi strategy can be used with any currency, but the choice of timeframe is limited to the range from M5 to H4.

Strategy indicators

BB Heiken Ashi is a very accurate and effective strategy, which is based on the functioning of three indicators included in the standard Forex set and time-tested. For more accurate trading, some parameters in their settings should be changed.

- Bollinger Bands - technical indicator with a period of 10 and a deviation of 0.5.

- SMA (50) - simple moving average with a period of 50.

- Heiken Ashi - indicator for constructing candlestick charts. In its settings, only the color scheme used can be changed.

Trading with the BB Heiken Ashi strategy

Making trades using the BB Heiken Ashi strategy is very simple, since all the indicators included in it are included in the standard Forex set and are used in the strategy without changes, as intended, however, the Heiken Ashi indicator is used a little differently, but this does not make it using complex. To open a certain position, it should be taken into account the values of all indicators, namely the color of Heiken Ashi, the location of the price relative to the moving average, and its intersection with the Bollinger Bands. After all the conditions match on a certain candle, a position can be opened.

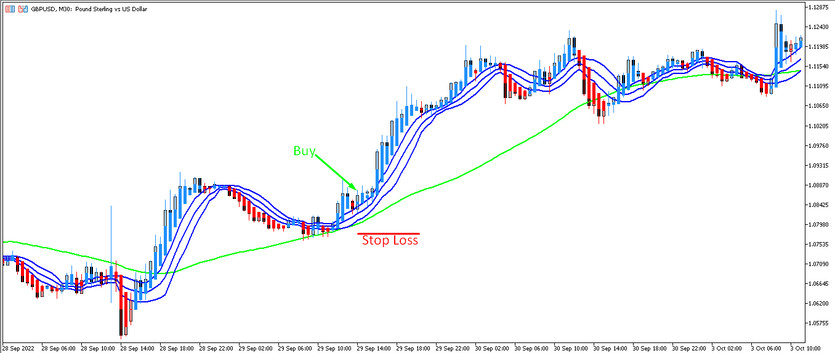

Conditions for Buy trades:

- SMA, directed upwards, crosses with Bollinger Bands and is located below. In this case, the current candles are formed above the moving average.

- All current Heiken Ashi candles must have a color with a rising value. However, only one candle, located before the signal, must have a color with a falling value.

When such conditions are received, a long position can be opened on a confirmed candle, due to the presence of an uptrend. Stop loss should be set just below the moving average. The trade should be closed upon receiving the opposite conditions from the indicators. This indicates the end of the current trend and the formation of a new movement, which will allow opening new trades.

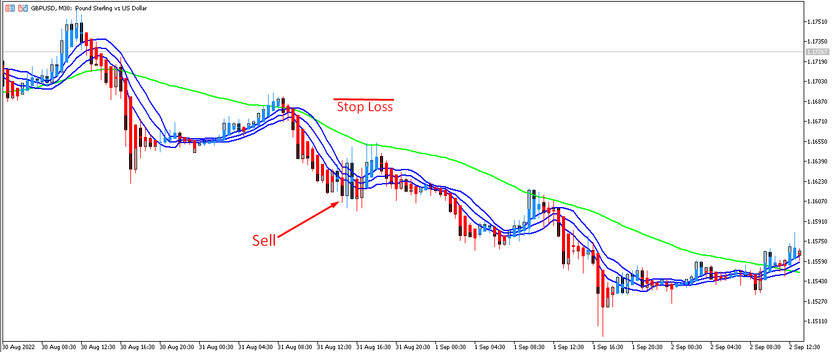

Conditions for Sell trades:

- Simple moving average, directed down, crosses with Bollinger Bands and raps above the bands. Candles are located below the moving average.

- All emerging candles of the Heiken Ashi indicator have a color with a falling value, but a candle that stands before the signal one should have a color with a growth value.

After the formation of these conditions on the signal candle, a sell trade can be opened, confirmed by a downtrend. A stop loss order should be placed just above the moving average. The trade should be closed after at least one of the indicators gives a reverse signal, which will indicate a possible change in the current market movement.

Conclusion

The BB Heiken Ashi strategy is a very effective and accurate trading strategy that allows you to trade during a certain trend period. In addition, it is very easy to use, since it is based on simple indicators. In order to correctly recognize indicator signals and be able to apply the strategy, preliminary practice on a demo account is recommended.

You may also be interested The EBB trading strategy for the EURUSD currency pair