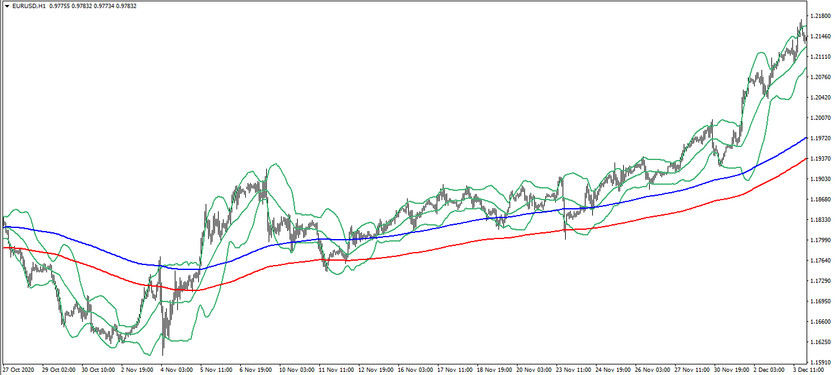

The EBB trading strategy designed for trading with the trend. This strategy is formulated from two indicators that make up the abbreviation EBB, Envelopes and Bollinger Bands, which in turn are included in the standard forex set. Both indicators, interacting with each other, help not only to determine the current trend and open a position in its direction, but also correctly place protective orders. The EBB strategy is not only effective, but also very easy to use, as it consists of the same easy-to-use indicators, so traders with any level of preparedness can use this strategy.

The EBB strategy is designed for the EUR/USD currency pair, which can only be used with an H1 interval. Other timeframes and currency pairs are not as profitable and effective with this strategy.

Strategy indicators

The EBB strategy includes only two indicators, but their number does not affect the effectiveness of the strategy at all. The indicators included in its composition are time-tested and have proven their effectiveness, which increases when these indicators interact. Both indicators are included in the standard forex set.

- Envelopes - indicator of the technical analysis of the market. Its period value is 288, the offset is 1, and the deviation is 0.15%, the calculations are applied to the Close price.

- Bollinger Bands - trading indicator whose values are 24,0,2, and the price type is Close.

Trading with the EBB strategy

Trades using the EBB strategy are very simple, because thanks to the indicators included in its composition, it is not only easy to determine the current trend and open a trade in its direction, but also to place protective orders correctly. First of all, before opening a trade, it should be got a certain combination of conditions, that is, it should be indicated the location of the candle relative to the Envelopes indicator, the intersection of Envelopes with Bollinger Bands, as well as their general direction. And after placing a stop loss using the Envelopes indicator, the trade can be closed when the current trend changes, that is, when a reverse combination of conditions is received.

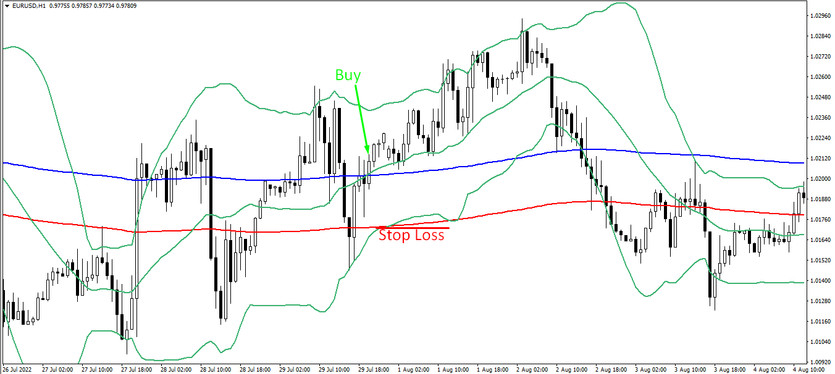

Conditions for Buy trades:

- The signal candle closes above the Envelopes indicator line with a growth value.

- Envelopes lines are moving up and its top line is crossing the middle line of Bollinger Bands.

After receiving such conditions, a long position can be opened on a certain candle. Stop loss should be set at the level of the lower line of the Envelopes indicator, while it should not be higher than 50 points. Close such a position should be after the Envelopes lines start moving from top to bottom, crossing the average the Bollinger Bands line down. In this case, it should be considered opening new trades due to a change in the current uptrend.

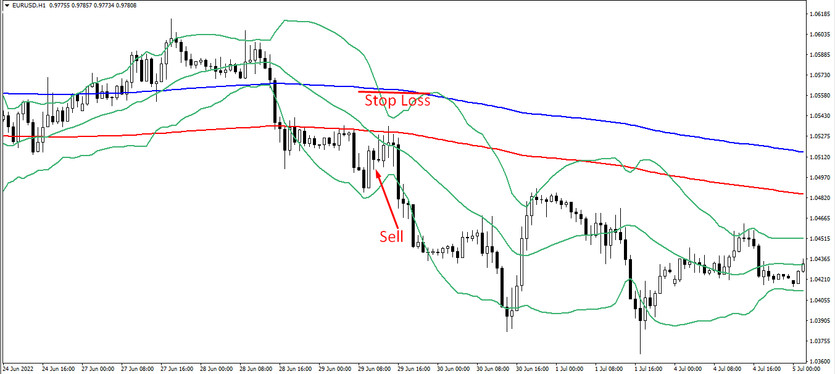

Conditions for Sell trades:

- The current candle closes below the lower line of the Envelopes indicator.

- Envelopes move down, crossing the middle line of Bollinger Bands.

After such a combination of conditions is obtained on a certain candle, a short position may be opened due to the presence of a downtrend. Stop loss should be set at the level of the upper Envelopes line. Close the trade after the Envelopes line crosses with the Bollinger Bands line in the opposite direction .This will indicate a change in the current trend, which will allow opening new trades.

Conclusion

The EBB strategy is a very logical and effective trading algorithm, which consists of time-tested elements. The strategy proves its effectiveness due to the profitability of the trades made with it. However, to get accurate results, it is needed to practice by using a demo account and preliminary study of the indicators included in its composition.

You may also be interested The Moderate Trading strategy for EURUSD and GBPUSD currency pairs