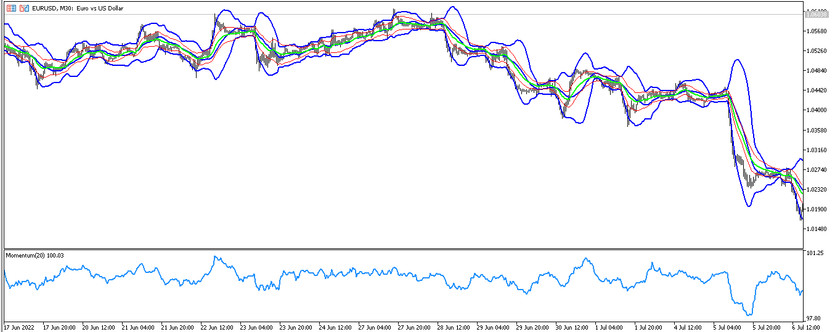

BB Momentum Keltner Channel is a trading strategy, the algorithm of which is based on the use of the calculations of three indicators, which are included in the standard set of Metatrader terminal. This strategy is used for trend trading, that is, trades are opened at a time when three indicators determine a certain market movement, thanks to which the direction of trades is determined. Strategy is built exclusively on trend indicators that work in strategy to confirm each other. Thanks to the indicators included in its composition, the strategy is very effective and accurate in the signals.

The BB Momentum Keltner Channel strategy is suitable for use with any currency pairs, while the timeframe should be higher than the M30 interval.

Strategy indicators

The BB Momentum Keltner Channel strategy consists of three indicators that are included in the standard Forex set, each of them is very effective, which is proven by time. One in order to correctly adjust the indicator for trading, it is recommended to change the indicators' settings, taking into account the selected timeframe and a currency pair.

- Bollinger Bands - channel indicator of technical analysis, reflecting the current price deviation based on a sliding average. The parameters are 20 and 2.

- Momentum - indicator of the price difference. The period is 20.

- Keltner Channel - technical channel indicator of the average measurement of the price for a certain period. The period is 20, and the type of sliding-uma.

Trading with the BB Momentum Keltner Channel strategy

In order to open certain trades using the BB Momentum Keltner Channel strategy, it is just needed to have basic trading skills and be able to correctly apply the indicators that are part of it in practice. Strategies work in trend trading. There is a Buy trades, for example, it opens at that moment, when all three indicators indicate upward movements, and the Sell trades, when the downward movement is determined. But if at least one indicator fits the return signal, the trade should not be opened, it is recommended to wait for a complete combination of conditions.

Conditions for Buy trades:

- The upper and lower borders of the Bollinger Bands indicator should cross with the Keltner Channel borders, and then Keltner Channel should be inside the Bollinger Bands channel and move up.

- The signal candle should be above the midline of the Keltner Channel indicator.

- Momentum indicator should move up.

Upon receipt of such conditions, on a signal candle, a long position may be opened, which is due to the presence of an ascending trend. Stop loss should be set at the level of the lower boundary of the Bollinger Bands indicator or at the point of the recent local extremum. Cover the position after at least one of the indicators A reference signal will be given, which subsequently can be confirmed by the remaining indicators. At this moment, you should prepare for the change of current trend and open new trades.

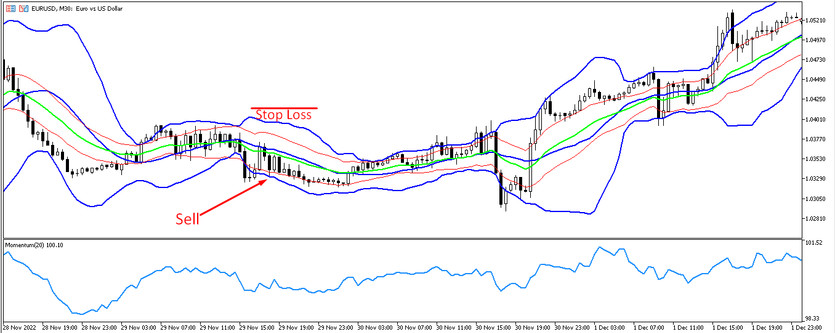

Conditions for Sell trades:

- Keltner Channel, after crossing the borders of the Bollinger Bands indicator, should be inside it and start moving down.

- The signal candle should be closed below the middle line Keltner Channel.

- Momentum should move in the direction from top to bottom.

A short position can open immediately upon receipt of a full combination of conditions characterizing the downward movement on the market. The Stop loss should be installed at the point of the recent local extremum or along the border of Bollinger Bands. The conditioning should be closed immediately after at least one reverse signal, which can be confirmed by other indicators. At this moment, it should be prepared to open new trades, which are determined by the change of trend.

Conclusion

The BB Momentum Keltner Channel strategy is a very effective algorithm, the calculations of which are based on the use of standard indicators, which are time -tested. It is very easy to apply in practice, especially if trader have good skills in trade and be able to properly use indicators that are part of it. In order to correctly apply the strategy, it is recommended not only to practice using demo account, but also to study the algorithm for the work of indicators that make it up.

You may also be interested DSS CCI trading Strategy for Currency Pairs with USD