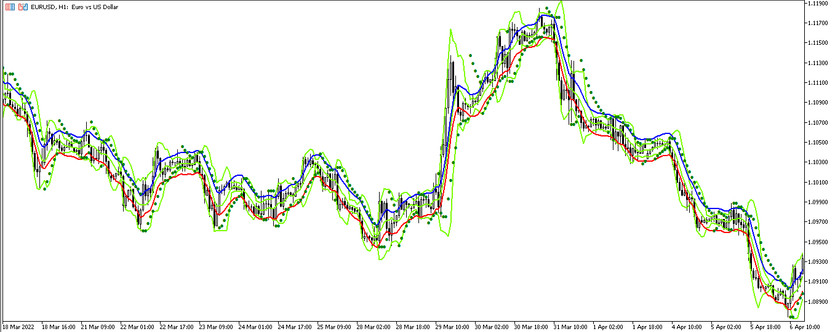

The BoliBands & Envelopes strategy is an algorithm designed to determine the current trend, and thereby identify the optimal points for entering and exiting the market. The indicators included in the strategy are not used quite standardly, but this does not make the strategy complicated and incomprehensible. Upon careful study all the nuances of trading with the help of the strategy, it can be made sure that it is very easy to use.

This allows traders with different levels of preparedness to use the strategy. This strategy breaks even, with a fairly large profit. Despite the practical absence of false signals, the BoliBands & Envelopes strategy is only suitable for the EUR/USD currency pair on the H1 chart.

Strategy indicators

The main components of the BoliBands & Envelopes strategy are the Bollinger Bands and Envelopes indicators, which is clear from the name of the strategy, and to confirm their signals, it is needed to use the Parabolic SAR indicator. Due to the combination of frequently used indicators, due to its effectiveness, a very profitable, but simple strategy was formed.

- - Bollinger Band- a price deviation indicator, the calculations of which are applied to the Weighted Close price, while its period is 6, the shift is 0, and the deviation is 2.

- -Envelopes - an indicator for determining price fluctuations. Its parameters are set to 8.0 and 0.1. It uses a moving Linear weighted, and the calculations are applied to the Median Price.

- -Parabolic SAR- a trend reversal indicator with a step of 0.14 and a maximum of 0.2.

Trading with the BoliBands & Envelopes strategy

At first glance, the use of the BoliBands & Envelopes strategy in practice may seem complicated, but this is far from being the case. Just during trading, it should be first of all monitored the location of the Bollinger Bands and Envelopes indicator lines. After the desired location of the lines in relation to each other, it should be pay attention to find Parabolic SAR points, and then opened a position in a certain direction.

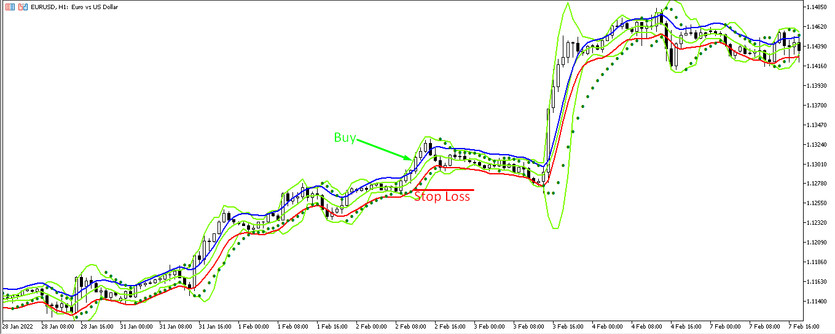

Conditions for Buy trades:

- -All lines of the Bollinger Bands indicator should be in the channel formed by the lines of the Envelopes indicator.

- -Then the upper and lower lines of the Bollinger Bands go outside of this channel.

- -The points of the Parabolic SAR indicator should be below the price.

After the Bollinger Bands lines exit the channel, taking into account the above conditions, a long position can be opened. The position should be closed when the Bollinger Bands lines enter the Envelopes channel again, and consider opening new trades. Stop loss should be set at the level of the lower line of the Envelopes indicator.

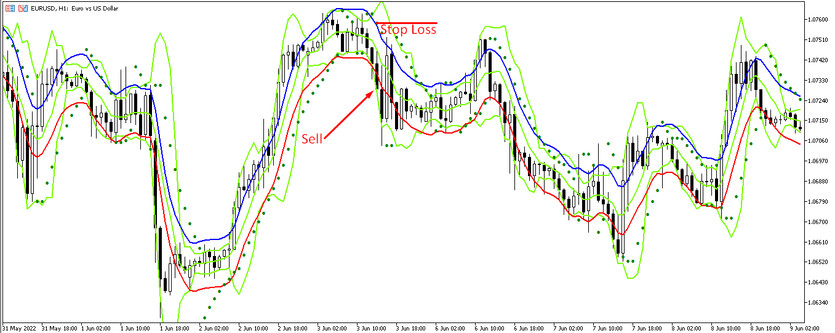

Conditions for Sell trades:

- -The Bollinger Bands indicator should be between the Envelopes lines.

- -After that, the Bollinger Bands indicator should go beyond the Envelopes lines.

- -At the same time, the points of the Parabolic SAR indicator should be above the price.

After the Bollinger Bands lines exit from the Envelopes channel, taking into account the Parabolic SAR values, a short position may be opened, which should be closed after the return of the Bollinger Bands lines, since in this case a new trade is considered. Stop loss should be set at the level of the upper channel line.

Conclusion

The BoliBands&Envelopes strategy is very easy to use, since the conditions for making buy and sell trades are almost identical, and differ only in the location of the Parabolic SAR points. It is also convenient that a new trade can be opened upon completion of the current trade. However, before using any strategy or indicator, practice on a demo account is always recommended.