The concept of the Calm Market trading strategy is to find the optimal points for opening positions when the volatility in the market decreases, that is, in the absence of a sharp and prolonged rise or fall in prices. But despite the fact that the strategy is designed to be used during a calm market movement, it can be used and with an increase in volatility, however, more effective results are established precisely with a calm movement. It should be taken into account that the strategy is used exclusively on the H1 interval with the GBP/USD currency pair.

Strategy indicators

The Calm Market strategy uses standard forex indicators that are not often in demand. However, despite this, the strategy shows excellent results, especially during a calm price movement.

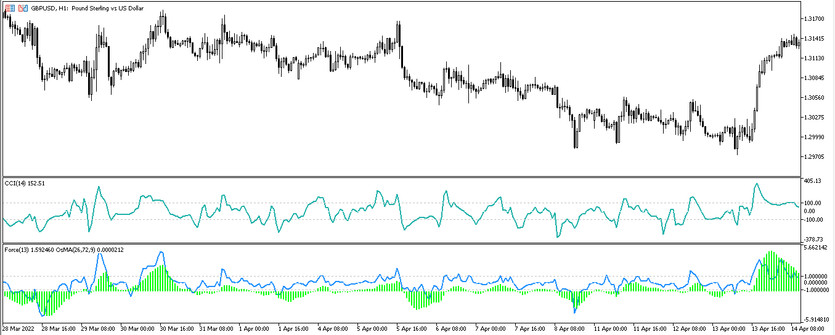

- -CCI-indicator that allows to traders determine the change in the market trend. The indicator is applied directly to the lower window of the price chart without changing its parameters.

- -Force Index-using this indicator, the position of the strength of the current market trend is determined. The indicator is also applied to the lower chart window with levels 1 and -1 set and period 13.

- -Moving Average of Oscillator - an indicator that determines the difference between the oscillator and its smoothing. The indicator is superimposed on top of the Force Index indicator and has a value of 26,72,9.

Trading with the strategy

Despite the fact that the indicators included in the composition are not the most common, their use in the strategy is not difficult. Indicators in the strategy are used for their own purpose, therefore, in order to fully have information about the use of the strategy, it is recommended to study each indicator that forms its basis. When making trades, it is imperative to comply with all conditions, otherwise the trade will not show the desired result. Also, a prerequisite is the transfer of the trade to breakeven after the formation of a reverse signal and closing at the current price, passing in the negative zone.

Conditions for Buy trades:

- -The CCI indicator crosses its -100 level from the bottom up and moves up to the level of 100.

- -Force Index characterizes the growth in relation to its previous movement, however, the indicator must be between its levels -1 and 1.

- -Moving Average of Oscillator is above its 0 level, that is, it is directed upwards.

If all of the above conditions match, then a buy trade can be opened on the next candle. The stop loss order is 30 points, and the take profit order is 60 points.

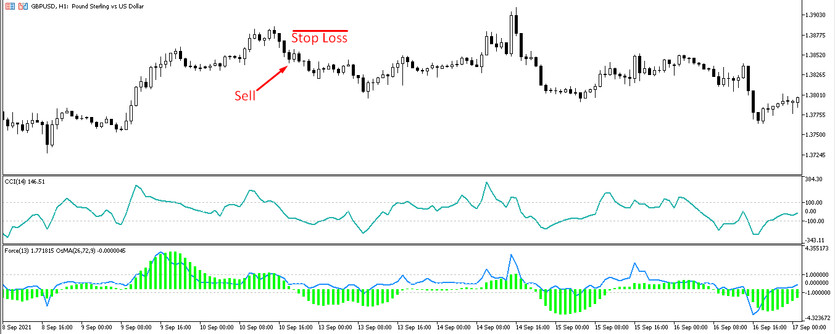

Conditions for Sell trades:

- -The CCI indicator line crosses the 100 level and moves down towards the -100 level.

- -The Force Index line indicates a decrease in relation to its previous movement, however, the indicator must be between its levels -1 and 1.

- -Moving Average of Oscillator histogram is below 0 and is directed downwards.

A sell trade can be opened on the next candle if all conditions matched. The stop loss order is set at 30 pips, and the take profit is twice as large.

Conclusion

The Calm Market strategy is very simple, but at the same time effective in use. Of course, one cannot deny the presence of false and even sometimes missed signals. However, this is extremely rare, since when used correctly, the strategy brings good results, which can improve the use of a demo account before trading on real deposit.