Range strategies are a very popular trading technique, especially in Asian countries, where traders often use them as so-called core strategies on which they literally base their entire trading.

Today's contradictory strategy is just one of those. It is a strategy that, on the one hand, does not offer traders who knows how big profits, but even here usually does not incur high losses, which is much more important in forex.

Strategy entry rules

Entering long positions

- Rising daily candles with High-Low range >=100pips

Entry into short positions

- Declining daily candles with High-Low range >=100pips

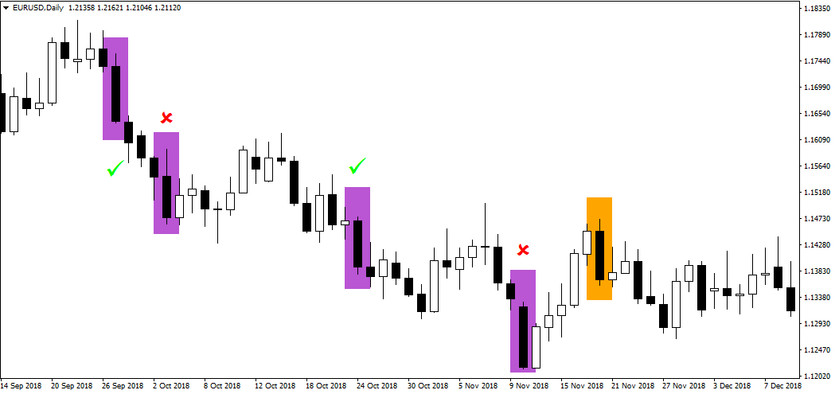

The chart below shows rising candles, their range (the range between High and Low) is equal to or greater than 100pips. The assumption of today's strategy then is that if the market forms such a daily candle, then subsequently the trend will persist and continue in the following days. The placement of the SL and TP here depends on the ratio between them that the trader chooses (a suitable placement of the SL may, for example, be a Low signal candle - a candle whose range has exceeded 100pips).

On the charts above and below it is possible to see, in addition to the marked candles, markings, where a cross means that in this case there would probably be a loss, a pipe means that the market the next day really continued in the given direction and an orange rectangle that the candle has the right range, but the development after this candle could bring both a loss and a profit (it would depend on the placement of SL and TP)

With this strategy, a long-term success rate of 30-60% can be achieved and its sustainability will depend heavily on trading skill and fine-tuned money-management.