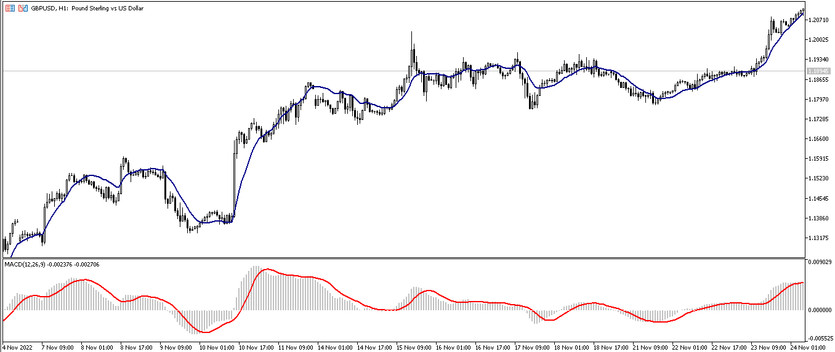

The DEMA MACD strategy is a trading algorithm based on the interaction of two indicators included in the standard Forex set. The strategy is very easy to use, as it is based on the confirmation of each other's signals by the indicators, that is, a trade is opened when both indicators give the same signal, otherwise In other words, they will determine the current market trend. At the same time, the DEMA indicator is more important in the strategy, since the MACD, in turn, serves to filter and smooth the trading signals of the first one. The algorithm itself is used to trade with the trend, that is, the direction of trades determines the current trend, the movement of which in turn determine the indicators of the strategy.

The DEMA MACD strategy is suitable for use with any currency pairs and timeframes, while it should be borne in mind that when choosing a specific timeframe or pair, the parameters of the indicators included in this strategy should also be changed.

Strategy indicators

The DEMA MACD strategy includes only two indicators, but this does not make it less effective. Both indicators are trend indicators and are included in the standard forex set, which greatly simplifies the use of the strategy.

- DEMA - double exponential moving average. When choosing the H1 timeframe, its period is set to 24, when choosing other intervals, the period remains unchanged, that is, 14.

- MACD - indicator of technical analysis and assessment of the current market. When choosing any values, the settings remain set by default, that is, 12,26,9.

Trading with the DEMA MACD strategy

In order to be able to correctly use and apply the DEMA MACD trading strategy for practical purposes, it is enough to have basic trading skills, and therefore it will suit even beginners, whose trading will be strengthened by a preliminary study of the indicators included in its composition. The strategy works exclusively on the trend and before opening of a certain trade, the current direction of the market is determined. If the DEMA indicator has determined an uptrend, and the MACD indicator, in turn, has confirmed it, buy trades are opened. And if DEMA determines a downtrend, which is also confirmed by MACD, sell trades are opened.

Conditions for Buy trades:

- The DEMA line should move upwards, while the current candlestick should close above it.

- The histogram of the MACD indicator, as well as its signal line, should be above the 0 level.

Upon receipt of such conditions, a long position may be opened on the signal bullish candle, due to the presence of an uptrend in the current market. A stop loss order should be placed just below the recent local extremum. Such a position should be closed after receiving a return signal from the DEMA indicator, since at this moment there is a possible change in trend, which in turn will allow considering the opening of new trades.

Conditions for Sell trades:

- The current candle should close below the DEMA indicator, which in turn is moving down.

- MACD should drop below its 0 level.

A short position can be opened on a bearish signal candle immediately after receiving such a combination of conditions that characterizes a downtrend in the market. Stop loss should be set at the point of a recent local extreme. The position should be closed after a change in the direction of DEMA, since at this moment a change in trend is possible, which will allow considering the opening of new positions.

Conclusion

The DEMA MACD strategy is very effective and shows excellent results in application. The indicators included in it not only give clear, but also very understandable signals, which in turn is a big plus for beginners or inexperienced traders. When trading with the strategy, only preliminary practice is recommended on a demo account, as well as correct money management.

You may also be interested The Aroon Parabolic SAR trading strategy for major currency pairs