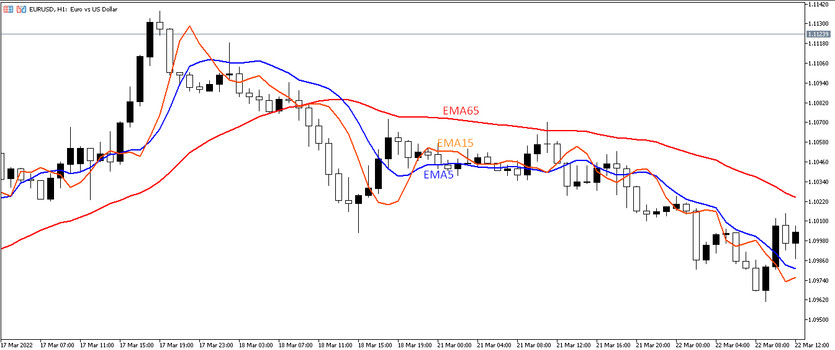

The Forex strategy Exponential Trend is a system based on three exponential moving averages, which is clear from the name of the strategy.

This EMA have different periods: 65, 15 and 5, which helps to make the trade more efficient and of high quality. One of the lines determines the market trend, and the other two are entry signals or exit from the market, taking into account its trend. The strategy is multi-currency, but for best results it is recommended to use major currency pairs. You can also choose the time interval at your own discretion, but most often the strategy is used on the H1 period.

Strategy indicators

The strategy is based on the use of one indicator, Exponential Moving Averages, with lines having different period values. The indicator is curved lines superimposed on the price chart. It is mainly used to smooth price values, eliminate false signals and maintain a position in a strong trend.

- EMA 65 is an exponential moving average with a period value of 65. The calculation of the average will be based on the closing price.

- EMA 15-exponential moving average with a period value of 15. The calculation of the average will be based on the closing price.

- EMA 5 - exponential moving average with a period value of 5. The calculation of the average will be based on the closing price.

Strategy signals

The strategy signals are formed and directly depend on the location of 3 exponential moving averages. To get a buy signal, the prices on the chart should be below the EMA 65 line. This will be a signal of an uptrend in the market. The moving average with a value of 5 should cross the moving EMA 15 from the bottom up. In the presence of the above factors, you can open a buy trade. A protective stop loss order is placed behind the nearest low, formed shortly before the intersection of the moving averages.

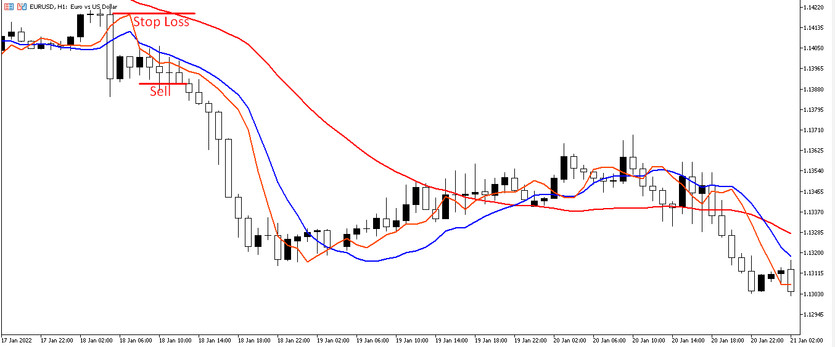

To form a sell signal, it is important that prices are below the EMA 65, and the EMA 5 crosses the EMA with a value of 15. A stop loss order is placed behind the nearest high formed shortly before the lines cross.

It is very easy to determine the current trend in the market using this strategy. If the price is above the moving average with a period of 55, then the trend is up. And if prices are below the moving average, then the trend will be down. Also, a side trend can be determined on the market, due to which many false signals may appear. In this case, it is worth especially controlling risks and not increasing the lot size.

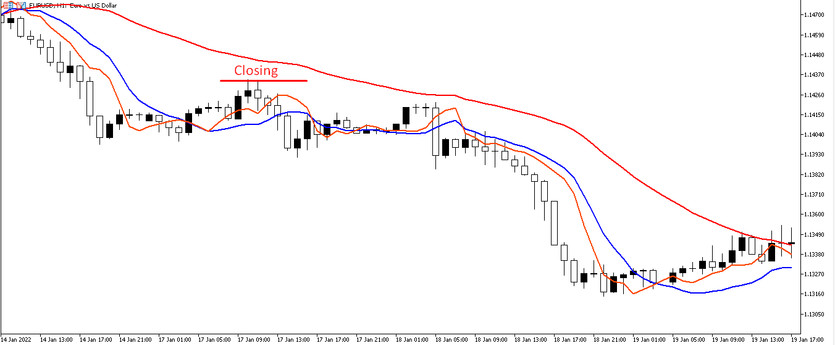

Trades are closed at the moment of the reverse intersection of two moving lines: EMA 15 and EMA 5. If the trend is up and the moving line with a value of 5 has crossed the line with a value of 15 from top to bottom, then the trade should be closed.

If the trend is down and at the same time the moving average with a value of 5 crossed the line with a value of 15 from the bottom up, then the trade should also be closed.

Conclusion

The trading system based on the Exponential Moving Averages indicator is a very simple, but at the same time very profitable and effective system, time-tested. The strategy has very simple signals to enter or exit the market. One of the advantages is trading in the direction of the current trend. But despite the presence of positive factors, the system can sometimes give signals with a delay. It will also have to constantly monitor the price chart for opening and then closing positions. However, when using a system with additional indicators, you can get good results.