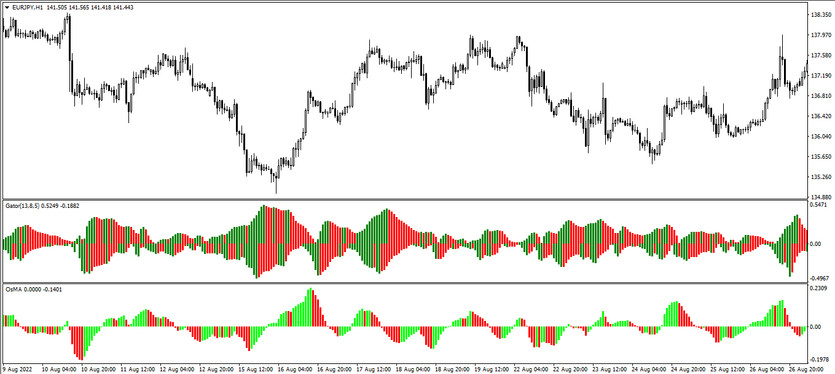

The GatOs trading strategy is a combination of the interaction of two effective indicators, which are histograms. Thus, interacting with each other, the indicators signal, and confirming each other's signals, determine the current market trend and find the optimal moment to open positions. The strategy is very effective and brings a good profit if all the trading conditions are met and the right instruments are chosen.

The GatOs indicator should be used exclusively with EUR/JPY and GPB/JPY pairs, since the indicator is not so effective on all other pairs. The choice of timeframe should also be treated carefully and intervals above D1 should not be chosen.

Strategy indicators

Despite the fact that the GatOs strategy consists of only two indicators, it is very effective. In the strategy, these indicators are used for their intended purpose, that is, one of them indicates the current trend and its strength, and the second confirms the signals of the first.

- Gator Oscillator - technical analysis indicator, whose parameters should be set to 13.8 and 5, and its shift values to 8.5 and 3.

- OsMA - modification of standard MACD with values 12,26,9

Trading with the GatOs strategy

The GatOs strategy is very easy to apply in practice, since the indicators included in it are quite easy to master. To open a certain position, it is first needed to determine the current trend. To do this, it should be monitored the values of both indicators. After what it should be opened position in the direction with the current trend.

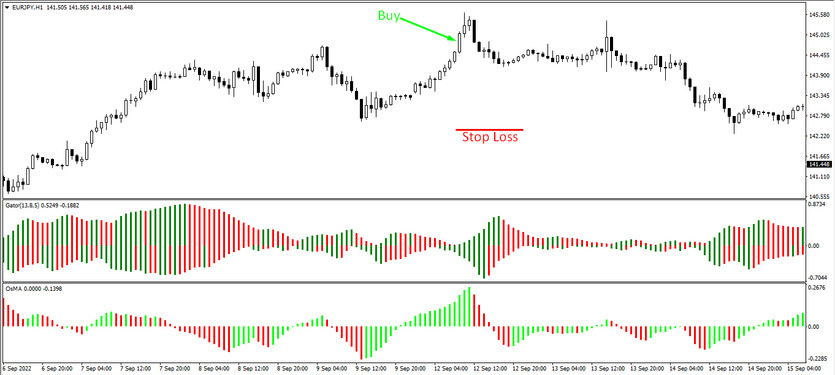

Conditions for Buy trades:

- Gator Oscillator is in the positive zone, that is, it has a solid column with a color with a growth value.

- OsMA is above level 0, and its bars are increasing in relation to the previous ones.

After receiving such conditions from the indicators, a long position can be opened at the opening of the next candle after the signal one. If the EUR/JPY pair is used in trading, then the stop loss is set at 125 points, and the take profit is 250 points, and if the pair GPB/JPY-stop loss is 200 points, then the take profit is 600. Close the trade as soon as at least one column of the Gator indicator will be colored with the fall value.

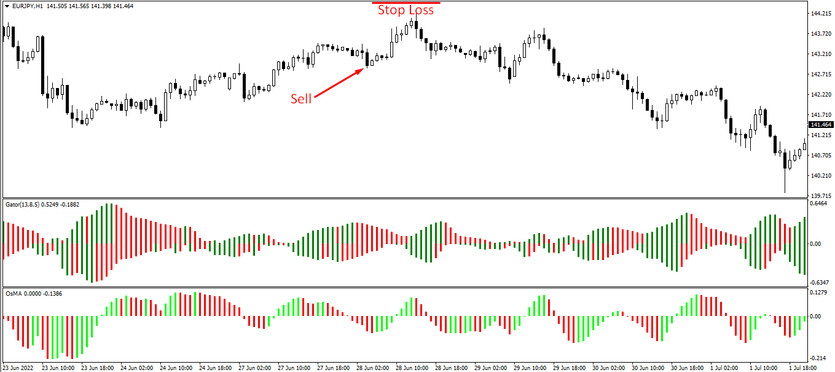

Conditions for Sell trades:

- The histogram of the Gator Oscillator indicator forms a solid column with the fall value.

- The OsMA indicator falls below its level 0 and is colored with the fall value, and its new bars are lower than the previous ones.

When receiving such signals from indicators, a signal to open a short position can be considered. Similarly with buy trades, the stop loss with the EUR/JPY pair is 125 points, and the take profit is 250 points, and if the GPB/JPY pair is 200 points, the stop loss is 200 points and the take profit is 600. Such a trade should be closed after coloring at least one column of the Gator Oscillator in the color with a growth value.

Conclusion

The GatOs strategy is very effective and shows excellent results with the EUR/JPY and GPB/JPY currency pairs, when choosing not too large timeframes. In order to correctly recognize the signals of the indicators included in it, it is necessary not only to study the scheme of operation of these indicators, but also to study the conditions for using the strategy on a demo account.