Gold was historically one of the few commodities that could be traded whether the earth was at peace and prosperous or, on the contrary, nations were in times of great war and turmoil.

Some may not like it, but gold has always been and still is a commodity that has increased in value over time. This is evidenced by its price trend over the last 20 years when it has averaged 11%/year, far higher than any inflation during that period. That's why we also present here a unique strategy that will also allow you to snatch a little of gold's growth eventually.

Strategy entry rules (example)

Enter long positions

- Mid-year (July)

Exit positions

- after a sure profit is made

- at the end of the year

How to trade with the strategy

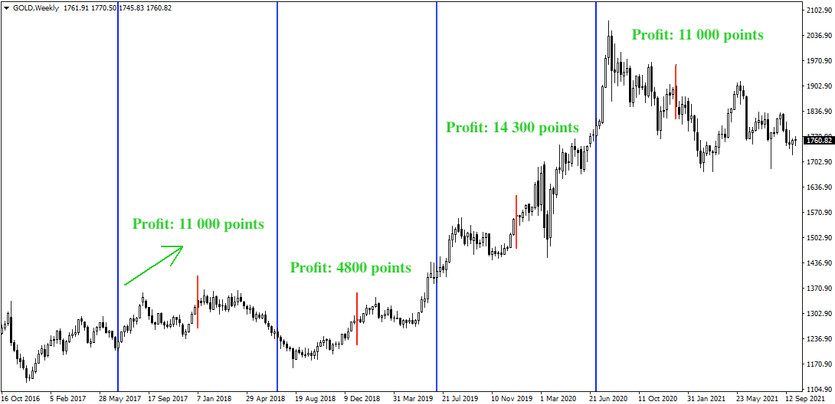

Today's strategy is straightforward in principle. Its main point is that the market generally goes through specific cycles each year where, for example, gold has long been observed to have a frequent tendency to lose money in the first half of the year, and the market then tries to make up for these losses in the second half. This has led to a gold strategy that involves long entries in the middle of the year and then closing them out either after making a profit or at the end of the year. So, as you can see, it's really not that complicated, but the profits can be high in some years.

The chart above shows that the Gold Strategy has performed impressively in recent years. If we talk about its overall success rate, it has been at 80% over the long term, which means that at most once every five years, the strategy will make a slight loss, which has been quickly erased each time in the following year.