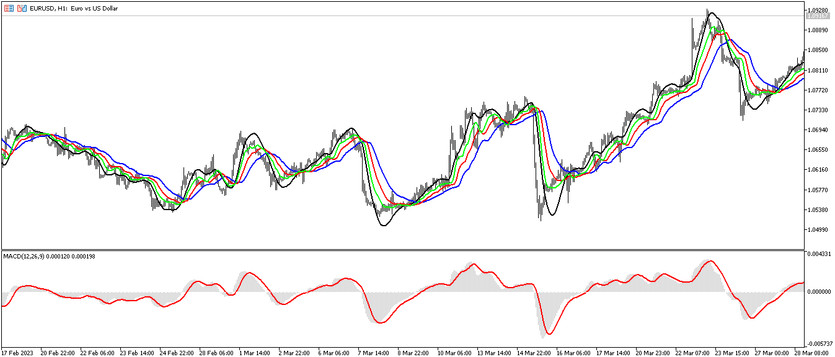

HMA Alligator is a trading algorithm based on the interaction of calculations of three indicators included in the standard Forex set, namely the Moving Average and the Alligator and MACD indicators. The indicators in the strategy work on confirming each other's signals, that is, any trade is opened at the moment, when the conditions of the signals of all three indicators coincide on a certain candle. Calculations of the indicators included in the strategy are aimed at determining the direction of the current trend, and only then opening trades in this period.

The HMA Alligator strategy is suitable for trading using any currency pairs, while the choice of timeframe is limited to H1 and H4 intervals.

Strategy indicators

The HMA Alligator strategy is based on the functioning of three indicators, the effectiveness of which has been proven by time. When the calculations interact, the strategy creates a very accurate signal, which is considered when opening a trade during the trend period. The values of the indicators included in the strategy should be changed taking into account the selected currency pair and timeframe.

- HMA - modified version of the standard moving average with a period of 36.

- Alligator - an indicator of the technical analysis of the market. Its parameters remain unchanged, that is, 13,8,8,5,5,3.

- MACD - trend trading indicator. Its settings remain set by default, that is, 12,26,9.

Trading with the HMA Alligator strategy

To open a certain trade using the HMA Alligator strategy, it is important to take into account the values of all the indicators included in it. In this case, the values of all indicators should be taken into account, and if one of them is late with the signal, the opening of a trade should be postponed. Indicators, in turn, serve to determine the direction of the current trend and open trades in this period.If the strategy indicators determine an uptrend, long positions, if the trend is down-short positions. Trades in both cases are closed at the moment the current trend changes.

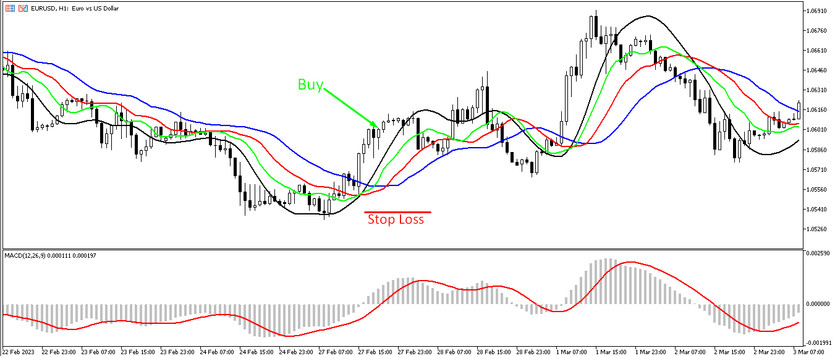

Conditions for Buy trades:

- The HMA indicator is heading up and crossing the Alligator lines above them.

- The lines of the Alligator indicator are arranged so that the Lips are on top, then the Teeth, and the bottom is the Jaw.

- The MACD indicator along with the signal line is above the 0 level.

Upon receipt of such conditions on a signal bullish candle, a buy trade can be opened, due to the presence of an upward trend. Stop loss is set below the HMA line or at the point of a recent extremum. The trade should be closed when the current trend changes, namely, when a reverse intersection of the HMA and Alligator indicator lines is received. At this point, it should be considered opening new trades.

Conditions for Sell trades:

- The HMA line crosses the Alligator lines from top to bottom, moving in that direction.

- Alligator lines intersect so that the slow line is on top and the fast line is on the bottom.

- MACD histogram together with the signal line falls below the 0 level.

A sell trade can be opened immediately upon receipt of such conditions on a bearish signal candle. A stop loss order is placed at a recent extreme point, below the HMA line. If the HMA and Alligator lines cross back, the trade should be closed. At this moment, a change in the current downtrend is expected, which in turn will allow considering the opening of new trades.

Conclusion

The HMA Alligator strategy is very effective due to the interaction of calculations of very accurate trading algorithms. For the correct application of the strategy and obtaining the necessary trading skills, it is recommended to study the indicators included in its composition and practice on a demo account.

You may also be interested The Stochastic Crossing HMMA Trading Strategy