The iTrend Lagguere strategy is a trading algorithm that is based on the functioning of the calculations of several effective indicators. The calculations of the strategy indicators are aimed at determining the direction of the current market trend and trading in this period. Any trade using the strategy is opened taking into account the direction of the trend, which in turn is confirmed by the interaction of the signals of indicators that are part of the strategy. When trading, it is important to take into account the signals of all indicators, since the strategy is based precisely on their interaction.

Trading using the iTrend Lagguere strategy can be made using any currency pairs, while the choice of timeframe is limited to the M15 interval, since the strategy is scalping.

Strategy indicators

The iTrend Lagguere strategy includes only three indicators, which, when signals interact, form an effective trading strategy. The values of the strategy indicators are used by default, while they change taking into account the selected currency pair.

- SMA - simple moving average with a period of 30.

- iTrend - indicator of technical analysis of the market, based on the use of a moving average with Bollinger Bands. Its parameters are equal to 13.20.

- Lagguere - trend trading indicator. The period is set to 0.7, signal levels 0.15 and 0.75 are also added to its settings.

Trading with the iTrend Lagguere strategy

Using the iTrend Lagguere strategy is very simple, as the strategy is based on simple and convenient indicators that are easy to use. It does not require any effort to open a certain trade. To begin with, the current trend is determined using the strategy indicators, and only then, taking into account its direction, directly and the trade itself. If an uptrend is determined, a long position is opened, if the trend is down, a short position. It is important to get a full combination of indicator conditions, in the absence of at least one of them, the opening of a trade should be postponed.

Conditions for Buy trades:

- The moving average moves from the bottom up, while the signal candle is formed above it.

- ITrend histogram is colored with growth value.

- The Lagguere indicator rises above the 0.15 level.

When a full combination of uptrend conditions is received, a buy trade can be opened on a bullish signal candle. Stop loss should be set at the point of a recent local extremum. Such a trade should be closed upon receiving the opposite condition from at least one strategy indicator. At this moment, a change in the current trend is possible, which in turn will allow to consider the opening of new trades.

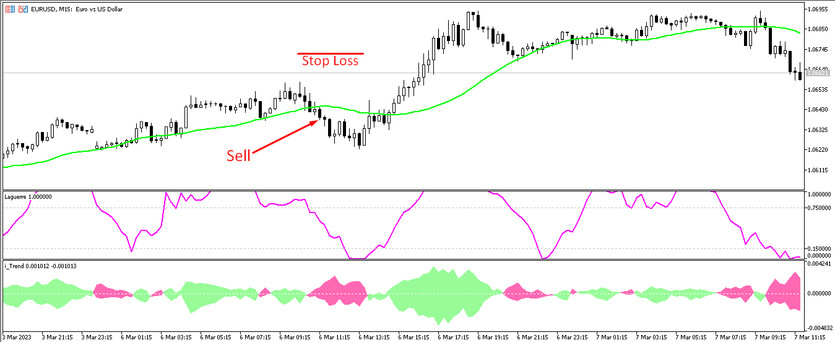

Conditions for Sell trades:

- The SMA indicator is above the signal candle and moving down.

- The ITrend indicator is colored with the fall value.

- The Lagguere line is moving down from the level of 0.75.

A short position can be opened immediately upon receipt of such conditions on a signal bearish candle. At this moment, a downtrend is determined in the market. Stop loss is set at the local extremum point. It should be closed the current position and consider opening new ones when the trend changes, at the moment when at least one of the indicators generates a reverse signal.

Conclusion

The iTrend Lagguere strategy is a very effective trading algorithm based on accurate trading indicators. For the correct application of the strategy, it is recommended to first study the indicators included in it, as well as practice on a demo account before trading on a real deposit.

You may also be interested The QQE Synergy Trend Universal Trading Strategy